Energy crisis: UK's 'particularly difficult' circumstances mean it's suffering worse than European neighbours

Many countries are suffering because of the dramatic rise in the price of gas, but the UK appears to be hit worse than most - here's why.

Monday 20 September 2021 18:37, UK

The United Kingdom is not the only European country to be suffering from problems with its energy supply.

All over the continent, prices are rising and customers are complaining, but Britain does seem to have a particularly difficult set of circumstances.

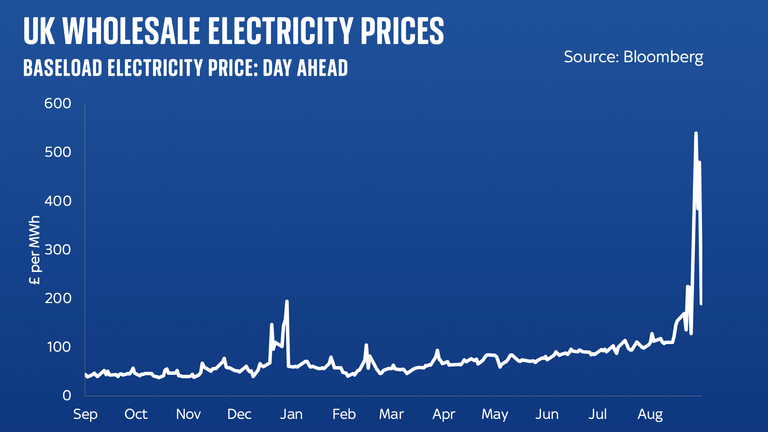

Take a look at the price of gas, for instance. Even for those companies prudent enough to buy their supplies months in advance, the price now is double, sometimes treble, what it was just a matter of months ago.

The price rise is so significant that the European Central Bank is already fretting about how this will affect information across the European Union.

Gas prices are going up because, quite simply, demand is higher than supply.

The summer heatwave led to increased consumption at a time when we normally see a dip, and the resumption of business after COVID-19 has pushed demand even higher.

Then there's the competition from Asian markets, as well as questions over the reliability of gas supplies from Russia. Put that together and you see the gas price soaring.

But not all countries are hit as hard.

France, for instance, isn't suffering in the same way because a great deal of its power comes from its own nuclear power stations.

Norway and Sweden generate lots of hydroelectric power; in Portugal, half of the energy supply comes from water or wind.

Germany tends to avoid problems because it's burning a huge amount of coal. Ditto in Poland, for example.

That's quite handy for the security of supply, albeit it's very bad for the environment, as well as people's lungs.

And there's the UK, which leans heavily into natural gas, with its soaring price.

Britain not only uses a lot of natural gas but has limited capacity for keeping it in storage, so has to rely on imports.

After Brexit, the UK left the European Union's Internal Energy Market, and there's little doubt that the supply process, between Britain and the EU, is now more clunky than it was before.

But, fundamentally, it's about the global gas price rising, rather than simply in Europe.

And there are other important issues.

Normally, the UK's supply could be supplemented by energy sold to us by France, and provided through the interconnector between the two countries but, as bad luck would have it, that system has been badly damaged by a recent fire that will require lengthy repairs.

At the same time, a number of the UK's most important nuclear plants are not working at full capacity and the recent calm weather has starved the grid of wind power.

That's why we saw coal-fired power coming back online recently.

And then, of course, there is the energy price cap that is designed to protect customers but is now creating the curious position where energy companies don't want to take on accounts from failed rivals.

The bottom line is that many countries are suffering because of the rapid and precipitous rise in the price of gas, but the UK does seem to find itself particularly badly affected.

And then there are environmental tariffs, added to bills all over Europe.

It might seem quite tempting to whip those out of energy pricing for the moment, in order to help customers and companies to ride out this particular storm.

But the money to pay for de-carbonisation has to come from somewhere. And in the UK, the government clearly feels that it can't position itself as a global leader on climate change if it also backtracks on environmental levies - and certainly not with COP26 on the horizon.

The flip side to that is that if customers find their bills to be intolerable, they might end up venting their anger at governments.

The Spanish prime minister, Pedro Sanchez, has already announced a new tax on utility companies, and a limit on price rises.

They, in turn, have told him that they could be pushed out of business. Sound familiar?