I Ran A Stock Scan For Earnings Growth And Proteome Sciences (LON:PRM) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Proteome Sciences (LON:PRM), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Proteome Sciences

Proteome Sciences's Improving Profits

In the last three years Proteome Sciences's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Proteome Sciences's EPS shot from UK£0.0005 to UK£0.001, over the last year. You don't see 100% year-on-year growth like that, very often.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Proteome Sciences shareholders can take confidence from the fact that EBIT margins are up from 6.4% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

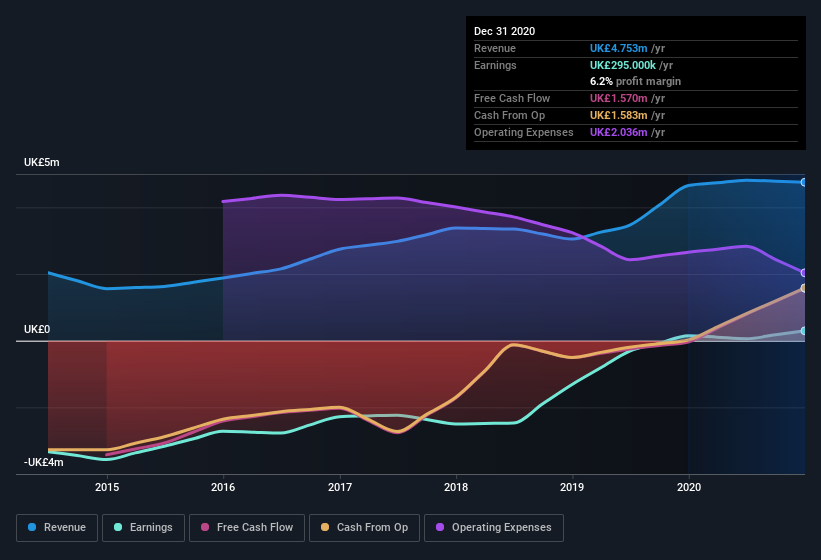

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Proteome Sciences is no giant, with a market capitalization of UK£23m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Proteome Sciences Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Proteome Sciences insiders spent UK£78k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Independent Non Executive Director Roger McDowell who made the biggest single purchase, worth UK£45k, paying UK£0.05 per share.

Does Proteome Sciences Deserve A Spot On Your Watchlist?

Proteome Sciences's earnings per share have taken off like a rocket aimed right at the moon. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Proteome Sciences on your watchlist. What about risks? Every company has them, and we've spotted 4 warning signs for Proteome Sciences (of which 2 are potentially serious!) you should know about.

As a growth investor I do like to see insider buying. But Proteome Sciences isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.