Three years ago an unassuming Kiwi couple working 16-hour shifts at a struggling petrol station made headlines around the world, as a latter-day Bonnie and Clyde in reverse. They never robbed a bank; instead their lender, Westpac, inadvertently handed them £4m when all they had asked for was a loan of £40,000. The accidental millionaires fled the country with much of the cash – and a "Good luck to you" from many who felt the couple had turned the tables on the thieving banks destroying the global economy.

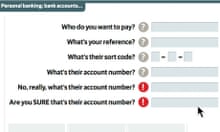

This week, we report on a woman who lost £26,000 after wrongly sending her pay into someone else's Nationwide account. The recipient who found the money pouring into her account, withdrew the lot in cash from ATMs and is refusing to pay it back. The money's been spent, she says, and she can't afford to repay.

It's not so easy to say "Good luck to you" in this case, is it? Yet they are morally and ethically identical. What both cases amount to is straightforward theft. The Kiwis knew the cash wasn't theirs – if a bank mistakenly sets your credit card limit at £300,000 rather than £3,000, it hardly means it's yours to grab and never repay. The Kiwis fled to Macau to launder their cash through the city's casinos, but their caper ended in tears. After two years on the run, one was arrested in Hong Kong, while the other came back voluntarily to New Zealand.

In court last year, one half of the couple, Leo Gao, said: "A lot of people say: 'You're lucky, like winning the lottery'. I say: 'Nothing worse could happen to you'." He was later sentenced to four years and seven months in prison.

In a similar case, a Pennsylvania couple quit their jobs and fled the state after withdrawing $175,000 (£110,000) that had mistakenly been credited to their account. They were arrested in Florida.

The sum involved in our story this week is much lower, but the principle is the same. As Julian Baggini, editor of the Philosopher's Magazine, wrote at the time of the Kiwi case, taking money wrongly credited to your account is "like stealing a car and saying it's the fault of the owner for leaving the keys in".

We don't know the identity of the person who has taken the £26,000 belonging to our reader; we'll only ever find out if the reader obtains a court order from Nationwide to disclose the identity. Maybe it will be a waste of her time and money trying to pursue the person. But that individual knows who they are. Whoever you are, do you really think you should pocket two years' of someone else's pay? Do the decent thing and pay it back.

The usual sanctimonious comments will, of course, appear "below the line" in the online version of our story. Our reader will be condemned as rich/stupid/feckless for failing to notice the disappearance of £1,000 a month. But are we about to start seeing many more of these stories? The banks are desperately keen to move to paperless statements, which will save them millions.

But the chances that errors will go undetected for months on end look set to rise rapidly. I used to scrutinise my telephone bill closely every quarter. Now it's paperless I often miss the email among the torrent of others. It will be the same with bank statements.

NatWest is moving millions of customers from monthly to quarterly statements. It says it will allow people to opt back into monthly if they so request. After hearing our reader's story, I'd be making that request.