Payday lenders have started to suspend new loans and tighten lending rules because of fears that low-income borrowers will not be able to afford repayments during the coronavirus crisis.

Doorstep lender Morses Club became the latest high cost creditor to withdraw loans for new customers on Monday. It comes nearly a week after sub-prime lender Amigo said it would temporarily pause all new lending activity, “given the ongoing uncertainty that the economic implications of Covid-19 could have for our customer base”.

Other high cost creditors are tightening their assessment criteria, which usually rely on a customer’s financial history over the past 30 to 90 days. But as the coronavirus crisis and lockdown continues, that data is becoming less reliable as an indicator of whether individuals will be able to pay their debts.

“Lenders that I have talked to are tightening their lending, and so the flow of credit is dropping,” Jason Wassell, the chief executive of the payday loans industry body the Consumer Finance Association, told the Guardian.

“All regulated lenders operate under rules of creditworthiness and affordability, with responsibility on lenders to make good decisions. For short-term lenders looking at the customer’s situation, the past 30 or 90 days are no longer a good indication of the next 90 days. Most firms are moving resources from opening new accounts to ensuring that their collections teams can cope and offer the right forbearance options.”

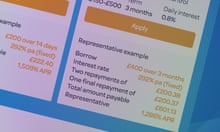

High cost lenders are taking additional precautions after a lack of proper affordability checks in recent years led to a surge in compensation claims that prompted the collapse of firms including Wonga, The Money Shop and CashEuroNet.

The UK’s coronavirus lockdown has also forced doorstep lenders to shift their loans and collections online.

Morses said its 1,695 agents were no longer making face-to-face visits for its home credit division, and that 82,000 of its near 280,000 customers are now registered to make payments online. Provident Financial Group, which operates under brands including MoneyBarn and Satsuma, said it was also suspending doorstep lending and collection through its home credit business last week.

Both firms have warned that in light of the economic uncertainty they were withdrawing any financial forecasts. Provident said: “We expect both our credit issued and collections performance to be adversely impacted during this period of uncertainty. It is too early to quantify the potential financial impact of Covid-19 on the group’s financial performance and, therefore, we consider it prudent to withdraw any forward guidance for 2020.”

Morses, which is headquartered in Leeds, has also said it would not recommend a dividend in July, given that it was not able to forecast the impact of Covid-19 on the business.

However the lender said it was in a strong financial position. It said 50% of its customers were on state benefits or pensions and that a significant number of its furloughed and self-employed customers could benefit from government grants announced by the chancellor, Rishi Sunak.

A spokeswoman for the debt charity StepChange said: “Some high cost credit lenders are not lending at the moment, and it’s understandable that people may feel concerned if they have little access to ready cash. But high cost credit can often store up more problems than it solves for people at the best of times.

“Many lenders, utilities companies and landlords will try to be flexible at the moment, so see if you can defer your payments for a while.” StepChange has urged people in immediate crisis to check its website for emergency information.