Hornby, the model train manufacturer that also owns Airfix, is to return some manufacturing from China and India to Britain, becoming the latest UK company to repatriate production because of rising wage costs in emerging markets.

The toymaker's announcement was made as figures suggested that Britain's monthly exports to China have hit the £1bn level for the first time, amid signs that UK firms are diversifying away from the crisis-hit eurozone.

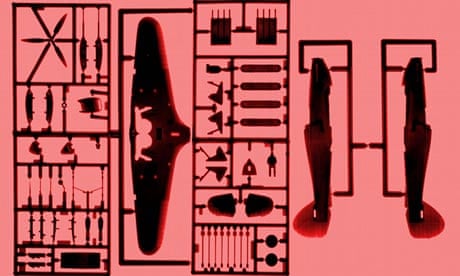

Hornby said it would be producing a new Airfix range that does not require glue, to be known as Quickbuild, in Sussex.

Its chairman, Roger Canham, told Sky News: "The economics of sourcing our products from China continue to be affected by the reducing availability of labour and increasing costs. In industrialised areas the minimum wage went up by around 15%, with wage inflation slightly ahead of that. You can no longer just apply the rule that manufacturing can be [done] elsewhere."

Hornby is part of the trend for re- shoring, or returning manufacturing from low-wage Asian economies, which has included UK companies such as Aston Martin, Topshop and Symington's, maker of the Golden Wonder pot noodle.

Revealing a rise in British exports to China , the Office for National Statistics (ONS) said there had been a marked change in Britain's trade over the past 18 months and the trade gap had narrowed by £600m in April.

Lee Hopley, chief economist at manufacturers' organisation the EEF, said re-shoring should benefit the indebted UK economy and assist exports. "They would be investing in capacity and modern machinery, potentially increasing their use of local suppliers and supporting the UK's net trade position – all good for rebalancing away from consumption and towards more trade and investment," she said.

The latest data indicated that the trade gap in April fell from £3.2bn to £2.6bn as imports fell more sharply than exports. An £8.2bn deficit in goods was partly offset by a £5.6bn surplus in services. Imports and exports fell in April but the 2.7% decline in the value of imports outstripped the 1.3% drop in exports.

Over the three months to April – considered a better guide to the underlying trend by the ONS – the deficit in goods and services widened by £500m to £9bn.

Since the second half of 2011, exports to the EU have fallen by 5% while those to the rest of the world have risen by 7%. In the quarter ending in April, exports to China were up by 11% and averaged more than £1bn a month.

Even so, the trade gap with China has deteriorated because the £300m increase in exports in the quarter ending in April was accompanied by a £500m increase in imports.

Britain's trading position with the US improved, with a 7% rise in exports and a fall in imports creating a quarterly surplus of £3.7bn.

But the deficit with Germany widened markedly. Exports to the UK's second-biggest market – after the US – fell by £800m to £7.5bn while imports were up £200m to £13.5bn.

"Since the autumn of 2011 the deficit with the non-EU countries averaged around £15bn over a three-month period; the deficit with the rest of the EU was around £11bn. The positions are now reversed," said Hopley.

Howard Archer, chief UK economist at IHS Global Insight, said: "Overall, it is clear that UK exports are continuing to struggle despite the marked weakening of the pound earlier this year. Obviously, muted and stuttering global growth is a problem, especially persistent weak domestic demand in the eurozone. Nevertheless, the export performance is still disappointing."

Comments (…)

Sign in or create your Guardian account to join the discussion