A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

cumbriatourism.org/dmp

Front cover image credits:

Brockhole-on-Windermere, Langdale Chase, Storrs Hall and visitlakedistrict.com

Plan images: unless credited separately, all images are copyright visitlakedistrict.com

2

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

This Destination Management Plan for Cumbria has been led by Cumbria Tourism in consultation with the following partners:

3

CONTENTS EXECUTIVE SUMMARY...................................................................................................................... 5 OUR VISION 7 PRINCIPLES OF THE DMP 8 THE ROLE OF THE VISITOR ECONOMY IN CUMBRIA 9 KEY OBJECTIVES AND INTENDED OUTCOMES 11 1 INTRODUCTION AND BACKGROUND 22 1.1 WHAT IS A DMP? 23 1.2 OUR DESTINATION 23 1.3 HOW IT HAS BEEN DEVELOPED 23 1.4 STRATEGIC ALIGNMENT OF THE DMP 23 2 HOW CUMBRIA IS PERFORMING ...............................................................................................24 2.1 KEY MESSAGES 25 2.2 SWOT ANALYSIS 28 3 VISION AND OBJECTIVES 30 3.1 OUR VISION 31 3.2 KEY OBJECTIVES FOR THE DMP 31 3.3 OBJECTIVE - INCREASING THE VALUE AND PRODUCTIVITY OF THE VISITOR ECONOMY 32 3.4 OBJECTIVE - RESPONSIBLE & SUSTAINABLE 37 3.5 OBJECTIVE - INCLUSIVE & ACCESSIBLE 40 3.6 OBJECTIVE - RESOURCED TO DELIVER 41 4 AMBITIONS AND OUTCOMES ....................................................................................................43 4.1 OBJECTIVE – DRIVE ECONOMIC GROWTH, INCREASING THE VALUE AND PRODUCTIVITY OF CUMBRIA’S VISITOR ECONOMY ...................................................................45 4.2 OBJECTIVE – ENSURE A SUSTAINABLE & RESPONSIBLE VISITOR DESTINATION 46 4.3 OBJECTIVE – ENSURING AN INCLUSIVE & ACCESSIBLE VISITOR DESTINATION ........................ 48 4.4 OBJECTIVE – SUPPORTING THE SECTOR TO DELIVER WORLD CLASS EXPERIENCES 49 5 OUR PLAN OF ACTION ............................................................................................................... 51 6 MANAGING AND MONITORING THE DMP 68 7 APPENDIX A – STRATEGIC ALIGNMENT ..................................................................................... 70 8 APPENDIX B – REVIEW OF THE EVIDENCE 73 8.1 IMPORTANCE OF THE VISITOR ECONOMY ................................................................................. 74 8.2 OUR VISITORS 79 8.3 WHERE VISITORS GO AND WHY THEY COME HERE .................................................................. 83 8.4 ACCOMMODATION 92 8.5 TRANSPORT AND DIGITAL .......................................................................................................... 93 8.6 OUR BUSINESSES AND PEOPLE 98 8.7 PLANNED INVESTMENT AND CHANGES .................................................................................... 99 8.8 KEY EXTERNAL TRENDS ............................................................................................................ 101 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 4

Cumbria is a top UK visitor destination and place of national and international appeal. It is home to two UNESCO World Heritage Sites (the English Lake District and Hadrian’s Wall), two National Parks (The Lake District and the Yorkshire Dales) and three National Landscapes (Silverdale & Arnside, the Solway Coast and the North Pennines, which is also designated as an UNESCO Global Geopark).

Through this shared Destination Management Plan (DMP), public and private sector partners are seeking to ensure a joined-up approach to support a successful visitor economy for the whole of the county, supporting economic growth, supporting the natural environment and delivering benefits for our host communities. The DMP seeks to ensure a balance between the economic benefits from a successful visitor economy and the need to support the environment and communities of Cumbria.

5 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

Catbells overlooking Derwentwater

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 6

Birdoswald Roman Fort, Hadrian’s Wall

Famed for our world-class landscapes and culture - by 2040 Cumbria will be Britain’s most vibrant and sustainable rural destination, boasting a reputation for quality, welcome, and an adventure for everyone - bringing benefits for our visitors, economy, nature and communities.

7 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

OUR VISION

The vision is long-term and will take �me to achieve. The key objec�ves and summary ac�ons for the next 6 years in this DMP (set out below) will move Cumbria towards the long-term vision. The plan will be monitored by a Steering Group1, with regular reviews of progress.

The DMP is ambi�ous and will require very strong partnership working and the ac�ve engagement of a wide range of partners across the public and private sector.

PRINCIPLES OF THE DMP

To support the DMP, all partners support and uphold the following principles:

3 1 2 4

Sustainable tourism will be at the heart of everything we do2 .

Our ac�ons will be evidence based, inclusive and equitable, respec�ul and suppor�ve of our communi�es and of benefit to visitors.

Collabora�ve and solu�ons focussed.

A commitment to maximising our collec�ve resources and exper�se and avoiding duplica�on.

1 Current membership includes: Cumbria Tourism (CT), Cumberland Council, Westmorland and Furness Council, Cumbria Local Economy Partnership (CLEP), the Lake District Na�onal Park Authority (LDNPA), the Yorkshire Dales Na�onal Park Authority (YDNPA), a Hadrian’s Wall representa�ve and CT Board representa�ves from the private sector.

2 Sustainable tourism is defined by the UN Environment Programme and UN World Tourism Organisa�on as “tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities”. This DMP uses the term sustainability in this broad sense.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 8

Cross Bay Walk, Morecambe Bay

THE ROLE OF THE VISITOR ECONOMY IN CUMBRIA

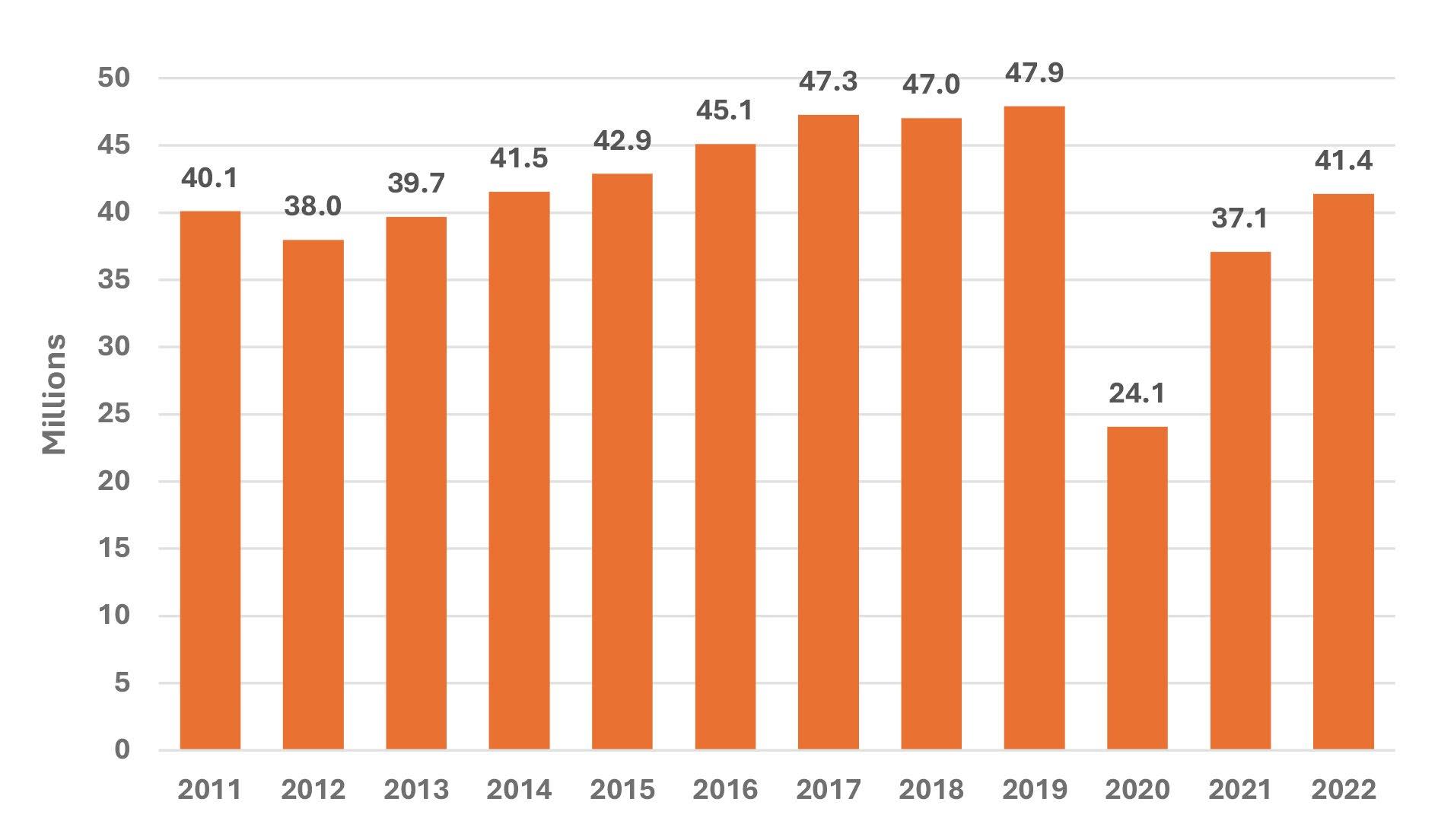

Cumbria has a large and important visitor economy. In 2022, the 41 million visitors in Cumbria generated around £4.1 billion of total spend in the economy including mul�plier effects. This supports £1.2 billion in direct gross value added (GVA) and overall, an es�mated 34,300 jobs directly (FTEs). Taking account of supply chain and mul�pliers, Cumbria’s visitor economy spend supports an es�mated 43,600 FTE jobs (19% of the county total) and around £1.6 billion in GVA (13% of Cumbria’s total). Throughout this DMP when we refer to visitors, this encompasses residents of Cumbria3, those visi�ng friends and rela�ves, those on business and other visitors from the United Kingdom and abroad. Improving the visitor experience will benefit all types of visitors.

As well as providing employment and being of economic importance, the visitor economy has a wider and significant role to play in suppor�ng vibrant communi�es through place shaping. That includes suppor�ng local authority priori�es; providing social and community benefits and pride; driving regenera�on; crea�ng jobs; suppor�ng public transport; underpinning a resilient supply chain; cultural, arts and heritage assets; and changing percep�ons.

9 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

3 In 2022 around a fi�h of visitors were residents of Cumbria and a further 12% were visi�ng friends and rela�ves here. Source: Cumbria Visitor Survey 2022.

Patterdale, Ullswater Valley

©Lake District National Park Authority

Changes and boosts prospects and places

Creates pride in places

Source: CT analysis and data drawn from Appendix B (see full Destination Management Plan)

Improves accessibility and inclusivity

Visitors spent £0.8 bn on food and drink and £0.5 bn in shops in Cumbria in 2022

Creates wealth and jobs

Support 43,600 FTE jobs (19% of total) and around £1.6 bn in GVA (13% of total)

THE VISITOR ECONOMY EFFECT IN CUMBRIA

Increases the appeal of Cumbria to live, work, study and invest

Helps sustain railway and bus usage and so routes

Supports a resilient supply chain

Drives inward investment

Encourages private investment

Reinforces cultural, heritage, retail and community assets

Supports sustainable transport infrastructure and active travel

Improves health and wellbeing of communities and the nation

Although the visitor economy brings the benefits outlined, it is also recognised as one of the poten�al contributors to pressures on housing, infrastructure and the environment in some parts of Cumbria. The purpose of the DMP is to enable partners to work together to mi�gate these impacts and maximise the benefits for all.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 10

Figure 1: Wider value and role of the visitor economy in Cumbria

KEY OBJECTIVES AND INTENDED OUTCOMES

The DMP has four key objec�ves, all of which are equally important and to a large degree interlinked. For each, there are a series of ambi�ons which partners will measure progress against. These are focused on achieving change by 2030, the key staging post towards the 2040 vision.

OBJECTIVE – DRIVE ECONOMIC GROWTH: INCREASING THE VALUE AND PRODUCTIVITY OF CUMBRIA’S VISITOR ECONOMY

This objec�ve is about growing the value of the visitor economy to deliver economic and social benefits by a�rac�ng visitors to stay longer, visit less well-known parts of the county4 and increase visits out of season. In doing so, this will support growth where it is needed and appropriate.

The aim of the DMP is to grow visitor value - including spreading visitors both geographically and over the course of the year - and encouraging visitors to stay longer, thereby reducing the pressures that visitor volumes can bring to certain loca�ons at key �mes and the impacts on Cumbria’s communi�es and residents.

Ambition: Grow the value of the visitor economy by 2030 up to a third in real terms, by:

3 1 2 4

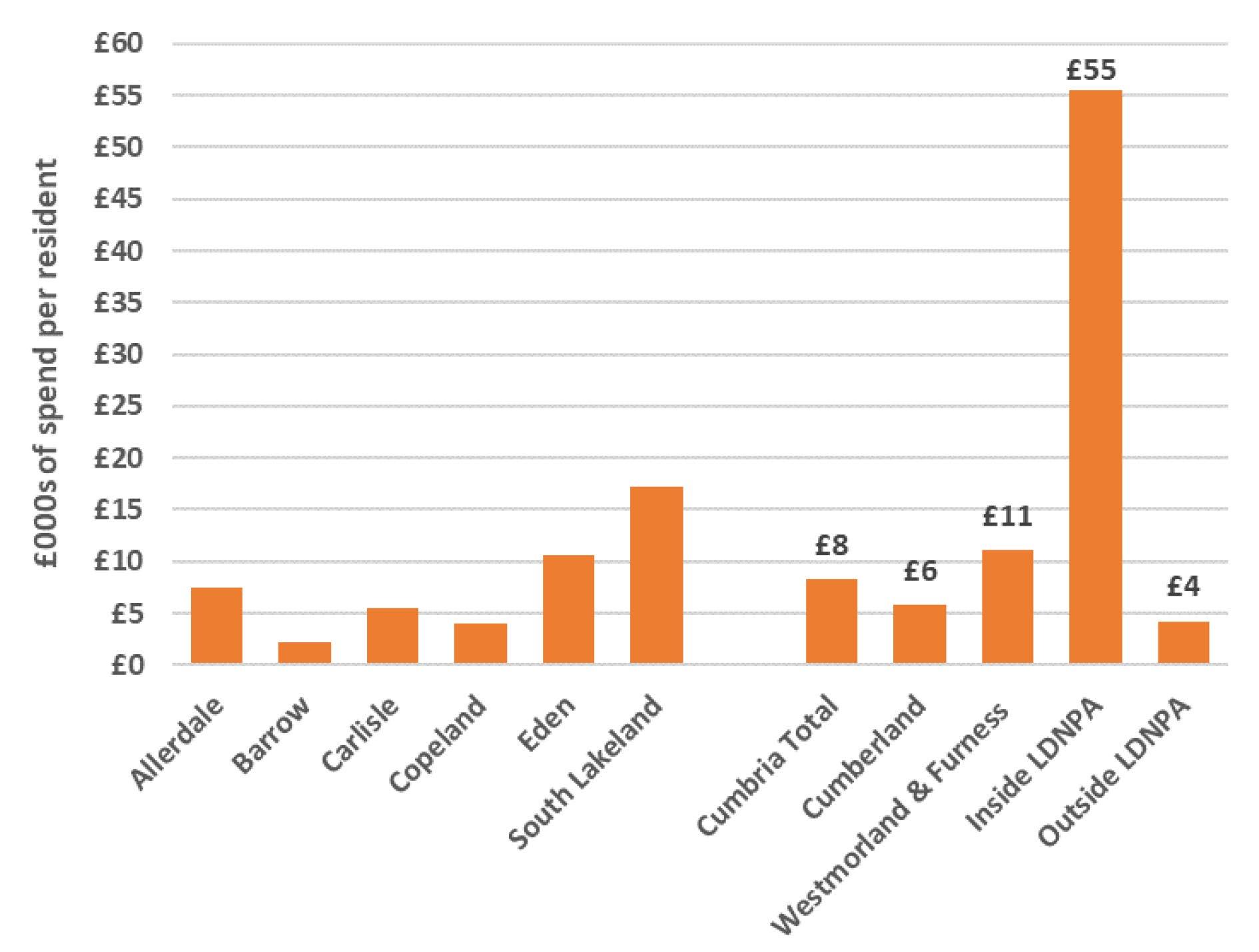

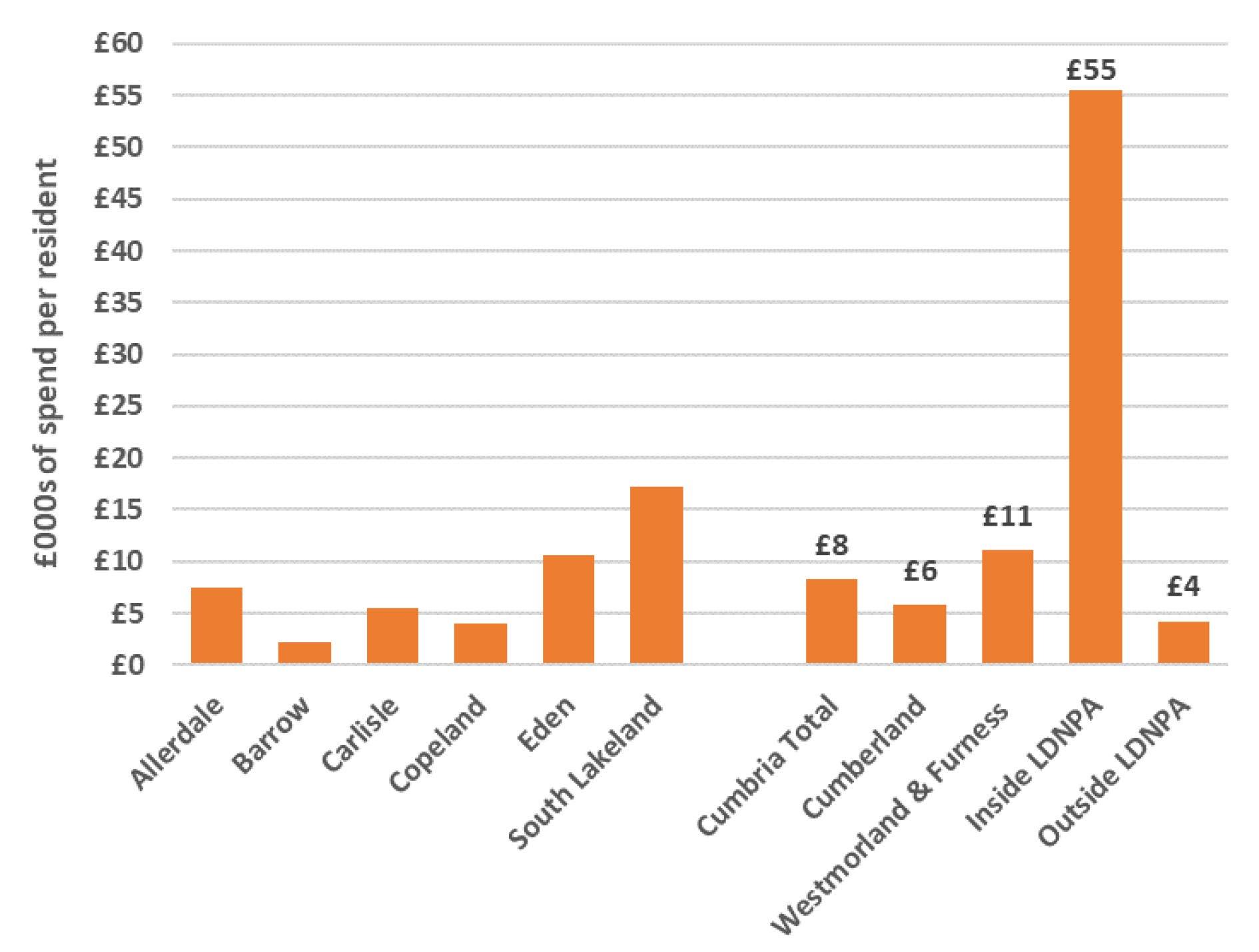

Increasing the value and share of tourism spend across the less visited parts of Cumbria (both day and overnight visitors) to increase the share of visitor spend outside the LDNP area from 47% in 2022 to 54%. Growth poten�al of circa. £500 million in total spend effects.

Increasing the value of tourism revenue outside the core period (April to September) and in shoulder months by circa. 10%, bringing seasonality more in line with the na�onal average. Growth poten�al of circa. £230 million in total spend effects.

Increasing the contribu�on of overnight visitors (through total visits and visitor days) by increasing the number and length of stays. Increase share from 43% in 2022 to 47.5% or increase average stay from 3.2 to 3.8 days. Growth poten�al of circa. £440 million in total spend effects.

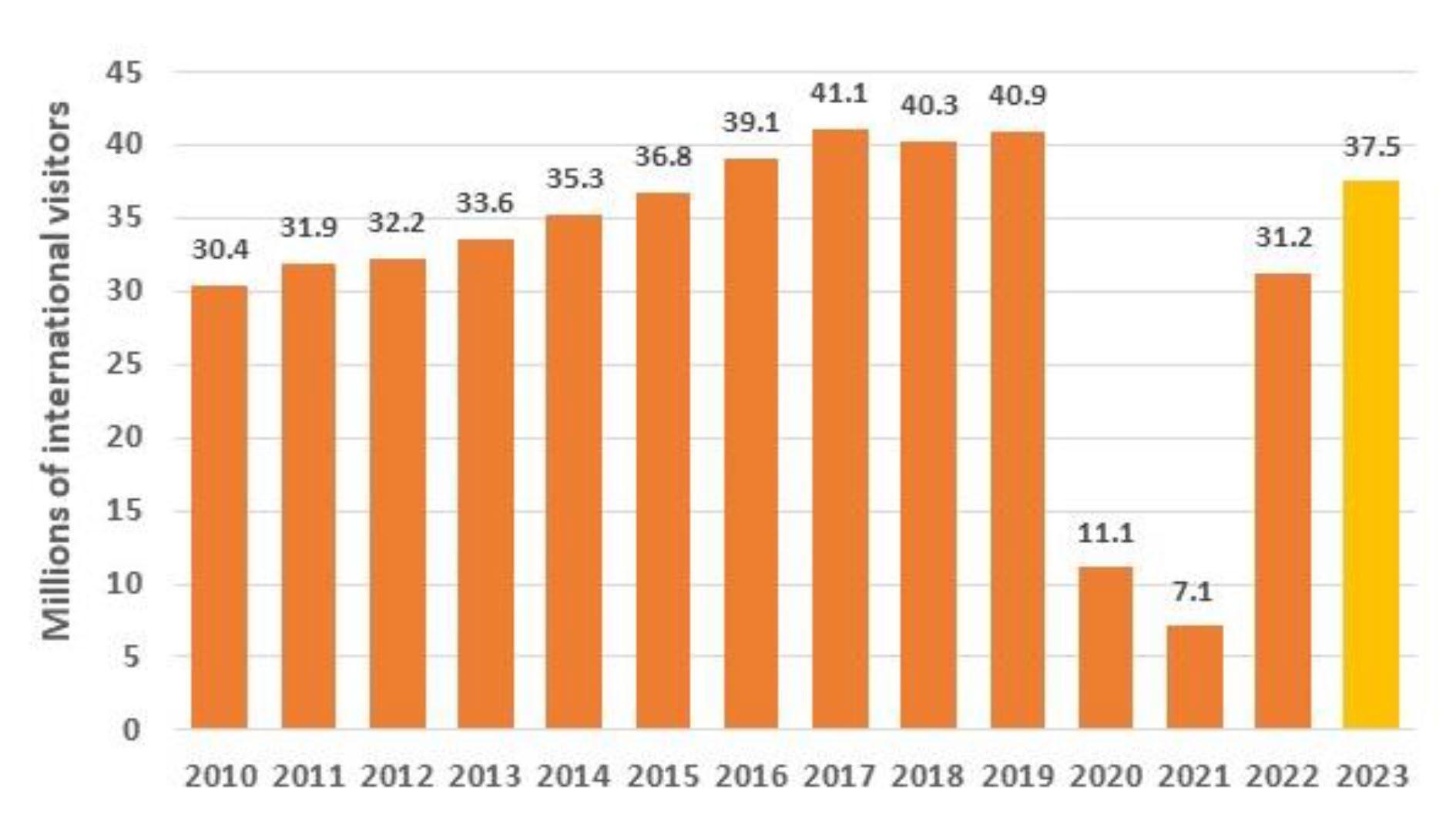

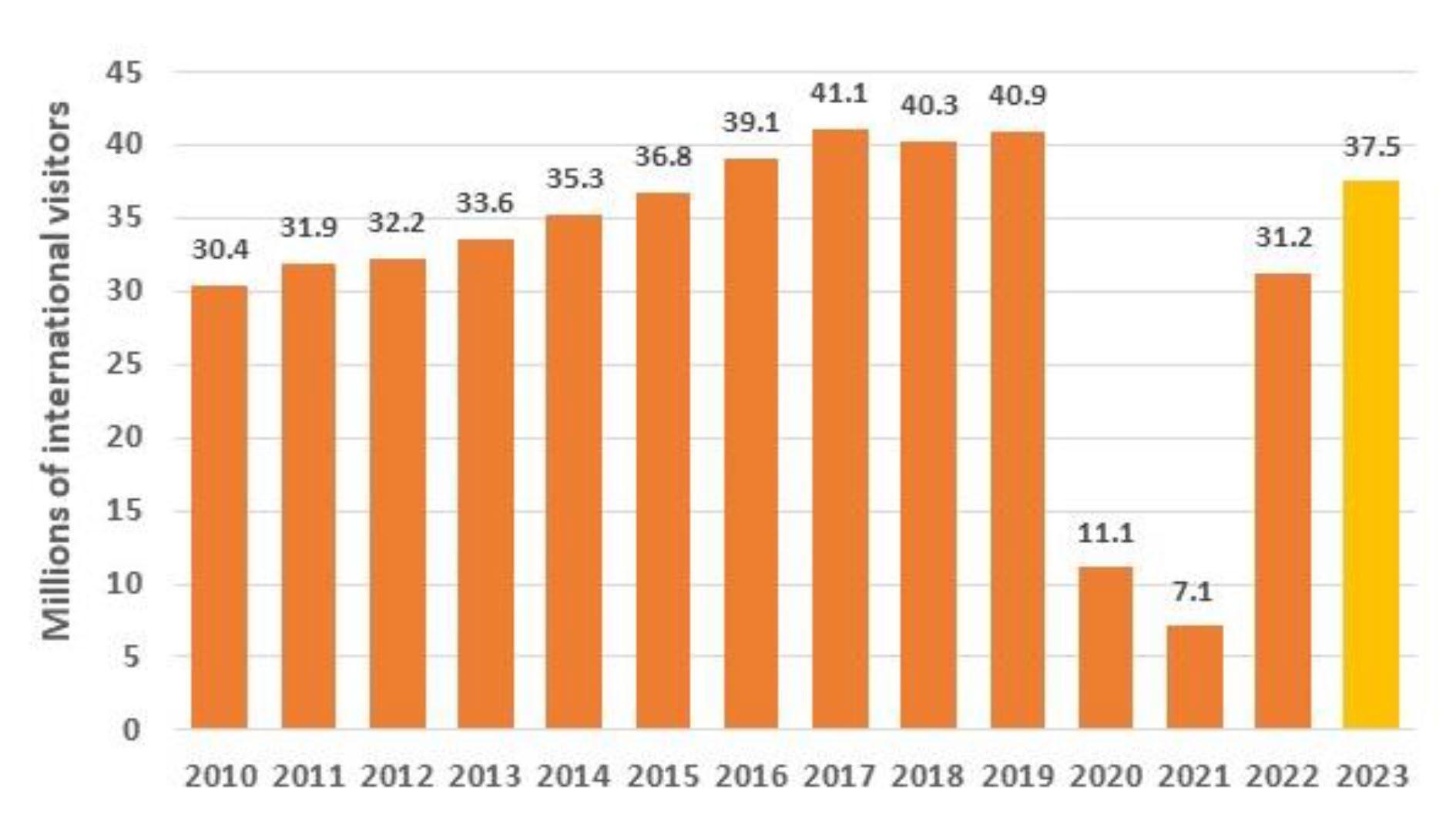

Increasing the number and share of interna�onal visitors to reach 15% of total visitor numbers5.

4 These are explained in more detail in sec�on 3.3 of the full Des�na�on Management Plan.

5 Note: This is complementary to the overnight visitor outcome. The focus is on a�rac�ng more interna�onal visitors who are coming to the UK anyway, so not increasing interna�onal air flights.

11 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 12

Carlisle Cathedral, Carlisle City of Lights

©Stuart Walker

South Walney Nature Reserve

Grasmere

©Stagecoach

OBJECTIVE – RESPONSIBLE AND SUSTAINABLE: SUPPORTING RESPONSIBLE TOURISM THAT BENEFITS THE ENVIRONMENT AND SUPPORTS VIBRANT COMMUNITIES

This objec�ve is about posi�oning Cumbria as a leading sustainable and responsible tourism6 des�na�on. This requires managing visitors as they journey to and within Cumbria to help improve visitor experience, reduce pressure on the environment and bring further benefits to host communi�es. It requires enabling low carbon experiences in ways which inspire, excite and a�ract. It is also about suppor�ng responsible rela�onships between visitors and the landscape, heritage and communi�es of Cumbria.

Much of Cumbria and many of its most visited places fall within important protected landscapesNa�onal Parks and Na�onal Landscapes (formerly Areas of Outstanding Natural Beauty or AONBs). In the case of the Lake District, its special quali�es7 contributed to the whole of the Na�onal Park being designated a World Heritage Site for its outstanding universal value as a Cultural Landscape. The special nature of Cumbria’s different landscape and environment are of course a key part of the appeal to many visitors. It is important they are celebrated, valued and maintained.

As well as carbon emissions, there are other environmental pressures in Cumbria created by our residents, by farming and other business ac�vity, and by visitors. Environmental challenges created by visitor economy ac�vity tend to be concentrated in certain loca�ons in Cumbria and can affect the environment and the landscape in ways that impact on the enjoyment of our environment for residents and visitors alike. The challenges created include water usage, water pollu�on, li�er/ waste, car parking and pressure on the visitor infrastructure (from toilets to footpaths).

As a globally leading environmentally responsible des�na�on, we need to con�nue to promote a culture of understanding of the area to the visitor and so encourage a philosophy of the valuing our natural capital (being the “loved des�na�on”) via responsible tourism ac�vity. This needs to go hand in glove with efforts by our visitor economy businesses to help educate visitors and make their own ac�vi�es as environmentally sustainable as possible. This applies both in the most popular des�na�ons in Cumbria and the under visited des�na�ons where there is the poten�al for growth.

Solway Coast National Landscape

6 Responsible tourism has a wider meaning than sustainable tourism and focuses on the economic and social impacts of tourism and the rela�onship between visitors and host communi�es as well as the environment.

7 See www.lakedistrict.gov.uk/caringfor/lake-district-special-quali�es There are 13 special quali�es which are: 1. A

landscape 2. Complex geology and geomorphology 3. Rich

13 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

world class cultural

archaeology and historic landscape 4. Unique farming heritage and concentra�on of common land 5. The high fells 6. Wealth of habitats and wildlife 7. Mosaic of lakes, tarns, rivers and coast 8. Extensive seminatural woodlands 9. Dis�nc�ve buildings and se�lement character 10. A source of ar�s�c inspira�on 11. A model for protec�ng cultural landscapes 12. A long tradi�on of tourism and outdoor ac�vi�es 13. Opportuni�es for quiet enjoyment.

Ambition: Improve the overall sustainability of visitor economy activity by: Transport8

Suppor�ng the aspira�on for Cumbria to be the first Net Zero carbon county by 2037, supported by a reduc�on in carbon from visitor travel of at least 15% on the 2018 baseline by 2030.

Improving the sustainability of travel in getting to Cumbria

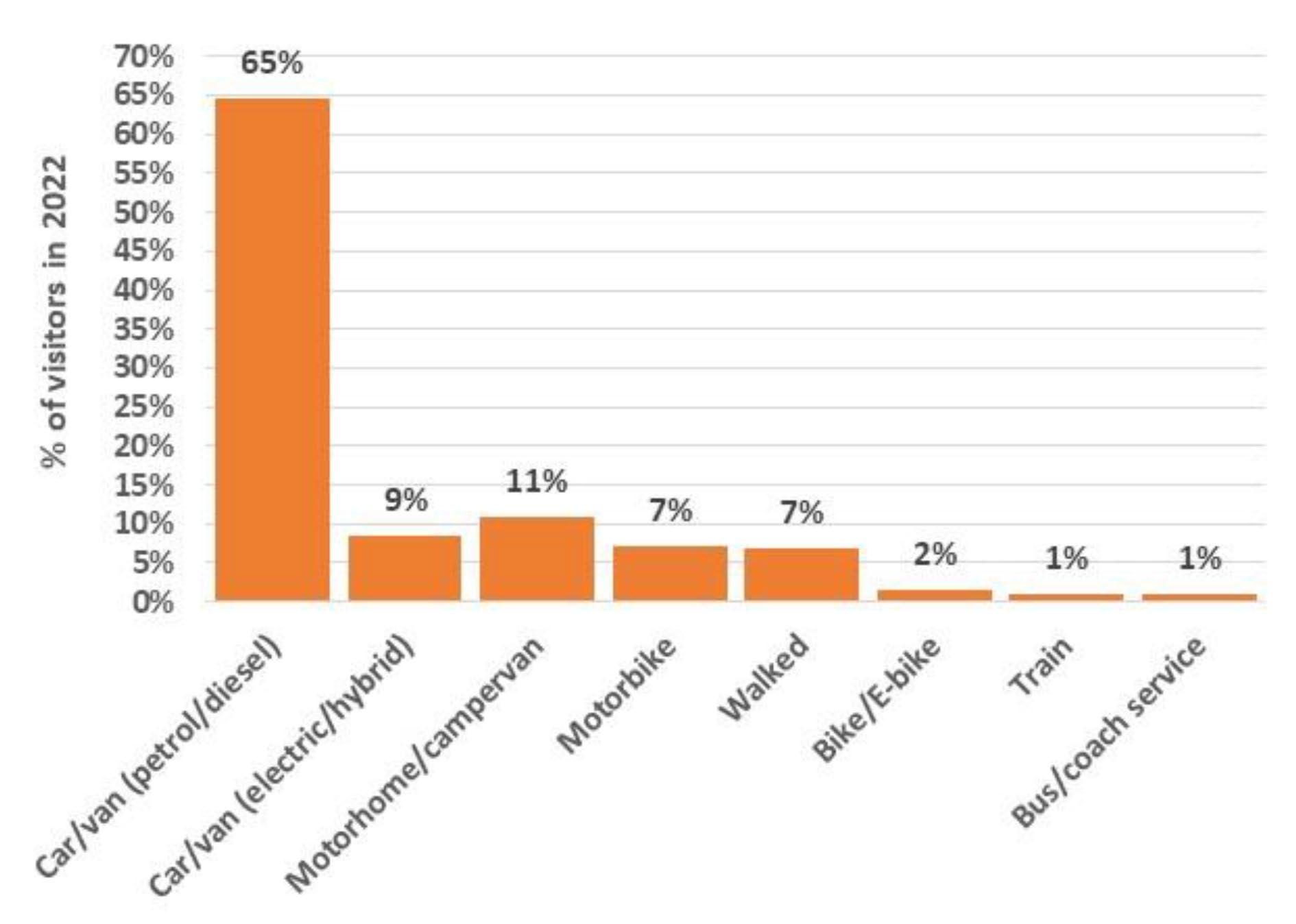

Increasing the share of visitors arriving in Cumbria by bus/coach and train from 9% in 2022 to 15% by 2030.

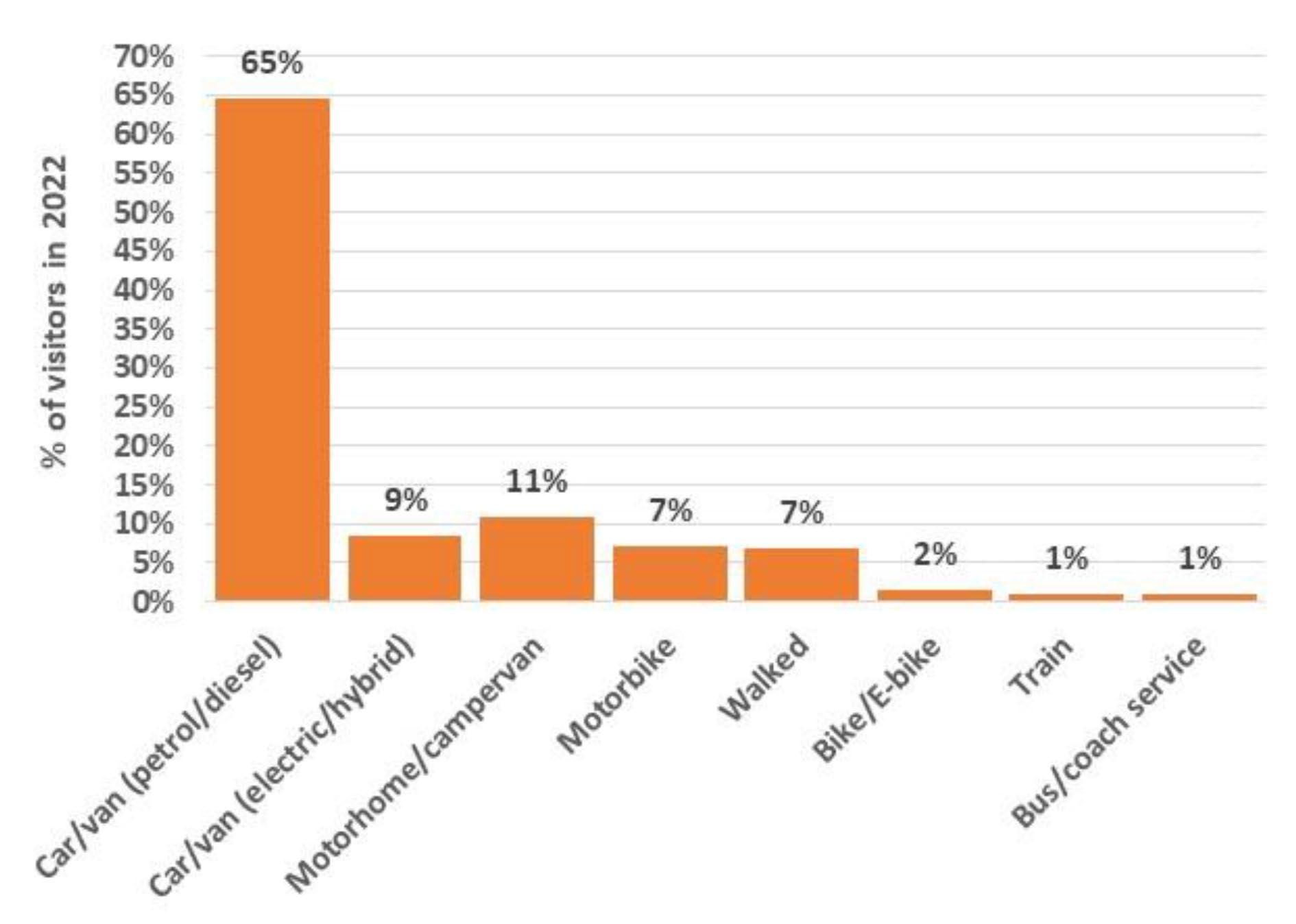

For those arriving by private vehicle, suppor�ng a growth in the propor�on using EV/hybrid vehicles from 10% in 2022 to at least 20%. This reflects the need to ensure Cumbria’s visitor economy can cater for the forecasted growth in EV car ownership and usage and does not get le� behind.

Improving the sustainability of travel in getting around Cumbria

Encouraging and enabling the use of sustainable and ac�ve travel op�ons, and increasing the main mode of travel recorded as ac�ve and sustainable from its 28% in 2022 to 40%.

Other

6 5 3 1 2 4 8 7

Increasing responsible tourism ac�vity, which is managed and monitored through plans led by the Strategic Visitor Management Group (SVMG) and reflected in reduced visitor environmental impacts such as li�er, fly parking and fly camping.

Increasing the propor�on of supply chain spend supported by tourism retained in Cumbria.

Delivering increased vibrancy and vitality to Cumbria’s city (Carlisle), towns and village centres by enhancing the evening economy, cultural offering (measured by employment growth and food/drink offer in town) and sense of pride in place.

Increasing the value of visitor contribu�ons to local causes (volunteering and visitor giving).

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 14

8 These targets assume that the external opera�ng environment for travel, which partners in Cumbria cannot influence, is as partners expect and as forecast (e.g. UK-wide roll-out of EV cars, etc).

OBJECTIVE – INCLUSIVE AND ACCESSIBLE: ENSURING ALL VISITORS CAN ENJOY CUMBRIA AS A DESTINATION

Being an inclusive and accessible des�na�on means being a des�na�on that a�racts and caters for all types of visitors which can offer “adventure for everyone.” This requires suitable facili�es, movement infrastructure, signage, informa�on and promo�on.

Ambition: improve the overall inclusivity of visitor economy activity by:

2 1

Improving Cumbria’s reputa�on as an accessible des�na�on and growing the value of the economy from visitors with accessibility needs by delivering the Accessible Cumbria Partnership Strategy.

Working in partnership to increase Cumbria’s reputa�on as an inclusive des�na�on welcoming to people from all visitor groups and backgrounds.

15 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

West Windermere Way, Miles without Stiles

OBJECTIVE – RESOURCED TO DELIVER: SUPPORTING THE SECTOR AND ENSURING THE INFRASTRUCTURE TO DELIVER WORLD CLASS EXPERIENCES AND MEET THE NEEDS OF COMMUNITIES

It is not possible to deliver on the DMP’s previous objec�ves without a suppor�ng infrastructure that has the capability to deliver world class experiences and a “warm welcome for all.” This objec�ve is about suppor�ng the visitor economy sector to be resilient, to operate effec�vely and to support innova�on and produc�vity in the sector. It also addresses the opportuni�es and challenges in the delivery of services to visitors and the need to manage these in a way that offsets impact on our communi�es.

Ambition: Supporting the sector and the infrastructure needed by:

2 1

4 3

Implemen�ng the workforce strategy for the visitor economy to address the skills gap and workforce shortage and reduce by a half the number of visitor economy businesses repor�ng the recruitment of staff as a significant problem (was 48% in October 2023).

Addressing access to affordable housing and the housing mix for staff and reduce by a quarter the number of visitor economy businesses repor�ng this as a significant problem (was 66% in October 2023).

Increasing the number of visitor economy businesses ac�vely engaged in measures to improve environmental sustainability

A�rac�ng increased investment across Cumbria to develop 5G and other advanced wireless technologies with the aim of reducing ‘not-spots’ and building future-proof mobile connec�vity for visitors, businesses and residents, businesses and visitors.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 16

BAHA, Bowness-on-Windermere

RESOURCING THE DMP

This DMP has a stretching set of objec�ves, priori�es and ambi�ons for Cumbria, with a comprehensive ac�on plan. The DMP will not be delivered without adequate resources from public and private sector partners collabora�ng together. The majority of ac�ons are already underway and being delivered from exis�ng budgets and plans or can be supported by partners working and sharing resources. However, there are some important ac�vi�es and proposed ac�ons that are not, as yet, resourced. The DMP will also help lever external funding from outside Cumbria.

17 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

Branthwaite Brow, Kendal

OBJECTIVE – DRIVE ECONOMIC GROWTH: INCREASING THE VALUE AND PRODUCTIVITY OF CUMBRIA’S VISITOR ECONOMY

OBJECTIVE – RESPONSIBLE & SUSTAINABLE: SUPPORTING

RESPONSIBLE TOURISM, BENEFITTING THE ENVIRONMENT AND VIBRANT COMMUNITIES

• 1A: Con�nue to implement strategy to raise appeal and awareness of less wellknown and visited parts of the county

• 1B: Grow the all-season offer and become known as a year-round des�na�on for all

• 1C: Regain and grow interna�onal spend and other higher value overnight stays

• 2A: Enhance and expand the opportuni�es and capabili�es for convenient, low carbon visitor movement and experience(s) both into and inside Cumbria for the benefit of visitors, residents and workers

• 2B: Promote and support sustainable and ac�ve travel and experiences

• 2C: Increase the local social and economic benefit from visitor spend, suppor�ng the vibrancy of our villages, towns and city

• 1D: Convert more visitors to overnight stays and extend the length of stays

• 1E: Adapt to and lead market trends and opportuni�es to ensure Cumbria a�racts future new and repeat visitors

• 2D: Encourage, educate and engage all visitors in responsible tourism, protec�ng and valuing our environment and communi�es

• 2E: Support ac�vi�es that sustain and enhance the environment

All requiring coordinated, evidence-led, targeted and appropriately funded marketing

• 2F: Ac�vely monitor and manage visitor pressure on key tourism des�na�ons

All requiring a coordinated approach to the strong use of data, evidence and intelligence gathering with a shared platform available to all to support joined up strategic visitor management

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 18

FIGURE 2: KEY OBJECTIVES & PRIORITY AREAS OF FOCUS, CUMBRIA DMP

OBJECTIVE – INCLUSIVE & ACCESSIBLE: ENSURING ALL VISITORS CAN ENJOY CUMBRIA AS A DESTINATION

• 3A: Ensure Cumbria’s infrastructure and welcome is accessible to all

OBJECTIVE – RESOURCED TO DELIVER: SUPPORTING THE SECTOR AND ENSURING THE INFRASTRUCTURE TO DELIVER WORLD CLASS EXPERIENCES AND MEET THE NEEDS OF COMMUNITIES

• 4A: Develop be�er infrastructure and a�ract investment in the quality and range of product

• 3B: Ensure Cumbria’s product and welcome is inclusive for all visitor groups

• 4B: A�ract, retain and develop a skilled and commi�ed workforce

• 4C: Support businesses to move to more environmentally sustainable opera�ons

• 4D: Support businesses to adapt, innovate and achieve excellence

• 4E: Ensure digital connec�vity (both mobile and fixed line) is fit for the future

• 4F: Ensure provision of adequate and consistent visitor services across Cumbria

• 4G: Ensure a joined-up approach to enable a resilient visitor economy

All requiring a coordinated approach to the strong use of data, evidence and intelligence gathering with a shared platform available to all to support joined up strategic visitor management

19 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

FIGURE 2: KEY OBJECTIVES & PRIORITY AREAS OF FOCUS, CUMBRIA DMP continued

FIGURE 3: KEY ACTIONS, CUMBRIA DMP

OBJECTIVE –DRIVE ECONOMIC GROWTH:

1.1: Invest in enhancing the quality of place in under visited loca�ons

1.2: Invest in enhancing the visitor product and experiences in under visited loca�ons

1.3: Funded and coordinated marke�ng and promo�on of under visited loca�ons

1.4: Support and extend programme of events and fes�vals outside peak periods and in less well visited parts

1.5: Iden�fy opportuni�es to develop more wet weather ac�vi�es and a�rac�ons to support tourism in off-peak periods

1.6: Funded and coordinated marke�ng and promo�on of Cumbria in off-peak periods

1.7: Funded and coordinated marke�ng and promo�on of Cumbria to interna�onal markets

1.8: Develop a strategic approach to promote Cumbria to film and TV produc�ons

1.9: Develop and implement a Cumbria food and drink strategy

1.10: Roll out a Cumbria motorhome strategy

1.11: Develop the CCR200 (Cumbrian Coastal Route) concept further

1.12: Increase local community awareness and use of and pride in visitor facing services

1.13: Research into new market opportuni�es

OBJECTIVE –RESPONSIBLE & SUSTAINABLE:

2.1: Enable more visitors to arrive in Cumbria via public transport

2.2: Market and promote visitor travel to Cumbria by public transport

2.3: Sustain and improve public transport infrastructure within Cumbria for visitors/communi�es

2.4: Develop an integrated end-to-end transport system for visitors with a proac�ve approach to parking provision and traffic management, to support modal shi�

2.5: Develop a suitable EV charging infrastructure for visitors in Cumbria and en route to Cumbria

2.6: Ensure planning to reduce traffic issues and minimise disrup�on at peak periods

2.7: Further expand and develop the network of cycling routes across the county

2.8: Place to Plate - develop local supply and sourcing programme

2.9: Create a responsible tourism educa�on strategy

2.10: Programme to teach and inspire young people about the countryside and environment awareness

2.11: Review opportuni�es for raising funding to support the vision

2.12: Invest in renewal and improvement of landscape enjoyed by visitors (inc. Fix the Fells)

2.13: Improve the environment of our waterways and coast

2.14: Ac�ve des�na�on management in key loca�ons

2.15: Data sharing and real-�me informa�on on visitors

2.16: Visitor safety management strategy

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 20

OBJECTIVE –INCLUSIVE & ACCESSIBLE:

3.1: Be�er provision of consistent and comprehensive informa�on on accessibility for visitors

3.2: Awareness raising and prac�cal advice about accessibility market and needs

3.3: Improve accessible and inclusive facili�es across the visitor economy infrastructure

3.4: Develop a be�er evidence base on needs and opportuni�es from new, inclusive visitor markets

3.5: Develop a strategic approach to ensure the delivery of Cumbria as an inclusive des�na�on

3.6: Support “warm welcome” programmes to make all visitors welcome

OBJECTIVE –RESOURCED TO DELIVER:

4.1: Support local businesses and organisa�ons to access grant and other funding opportuni�es

4.2: Help a�ract dis�nc�ve external investment into the sector

4.3: Review our affordable visitor accommoda�on offer for young people (and others)

4.4: Support skills development within the sector

4.5: Con�nue to raise awareness of career paths within the sector

4.6: Raise awareness of Cumbria as a place to live and work

4.7: Develop and extend worker transport ini�a�ves

4.8: Invest in new and expanded accommoda�on for workers in the sector

4.9: Support tourism businesses to develop ways to increase their posi�ve impact on the environment

4.10: Deliver a visitor economy innova�on programme

4.11: Develop a hospitality school of excellence

4.12: Roll out high-quality digital infrastructure to support mobile and fixed loca�on connec�vity for all visitors

4.13: Review and develop a joined-up strategy for toilet, waste and parking provision

4.14: Public realm review for key visitor des�na�ons across Cumbria

4.15: Enhance data sharing and intelligence gathering

21 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

FIGURE 3: KEY ACTIONS, CUMBRIA DMP

continued

INTRODUCTION AND BACKGROUND 1

1 INTRODUCTION AND BACKGROUND

Windermere Lake Cruises, Windermere

22

©Windermere Lake Cruises

1.1 WHAT IS A DMP?

Destination management is the process of leading, influencing and coordinating the management of all aspects that contribute to a visitor’s experience in Cumbria, taking account of the needs of visitors, communities, businesses and the environment.

This Destination Management Plan (DMP) is the shared strategy and action plan for sustainable tourism in Cumbria. It provides a long-term vision (up to 2040), a collective statement of intent to manage tourism in Cumbria, objectives and a prioritised 6-year action plan within an annual rolling programme of review. It articulates the roles of the different stakeholders responsible for their delivery and identifies clear actions they will lead on and the apportionment of resources. The work on the DMP has been led by Cumbria Tourism (CT) as the Local Visitor Economy Partnership (LVEP) for Cumbria but with a collective approach across all partners.

1.2 OUR DESTINATION

The jointly owned DMP has been developed for the whole of Cumbria. Within Cumbria, the Lake District is the key internationally known “attack brand” and is where visitor economy activity is most concentrated. However, visitors come to all parts of Cumbria and there are natural links and strong visitor interplay with areas surrounding the Lake District National Park which contain assets and opportunities that are complementary and often under-visited (such as Cumbria’s coast, Hadrian’s Wall, Morecambe Bay, the North Pennines and ‘where the Lakes meet the Dales’).

1.3 HOW IT HAS BEEN DEVELOPED

This is a jointly developed strategy for the whole of Cumbria and for all organisations and partners - public and private - involved in the management and delivery of services to visitors. There has been comprehensive consultation and input from a huge range of stakeholders. The development of the DMP has been evidence-led, utilising local data/trends and national sentiment surveys, as well as best practice from other destinations. A full draft was consulted on during November 2023 via a specific consultation event and online consultation. The draft DMP was also presented for feedback at events across Cumbria attended by 500+ businesses and representatives from other organisations.

1.4 STRATEGIC ALIGNMENT OF THE DMP

The DMP has been developed to build on, to be aligned and to contribute to existing national and local strategies (as shown in Table A1, Appendix A). In April 2023, two new unitary authorities were created in Cumbria: Cumberland Council and Westmorland and Furness Council. Both have produced initial plans and are embarking on updating and developing strategies for their areas. This DMP will help shape thinking and investment plans for the councils as part of the shared ambition for a coordinated DMP.

23 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

HOW CUMBRIA IS PERFORMING 2

24

Whitehaven Harbour

Appendix B provides a detailed review of the evidence on Cumbria’s visitor economy - past, present and future. It also maps out some of the planned investment that will impact on the visitor economy.

2.1 KEY MESSAGES

The key messages from this evidence analysis are summarised below:

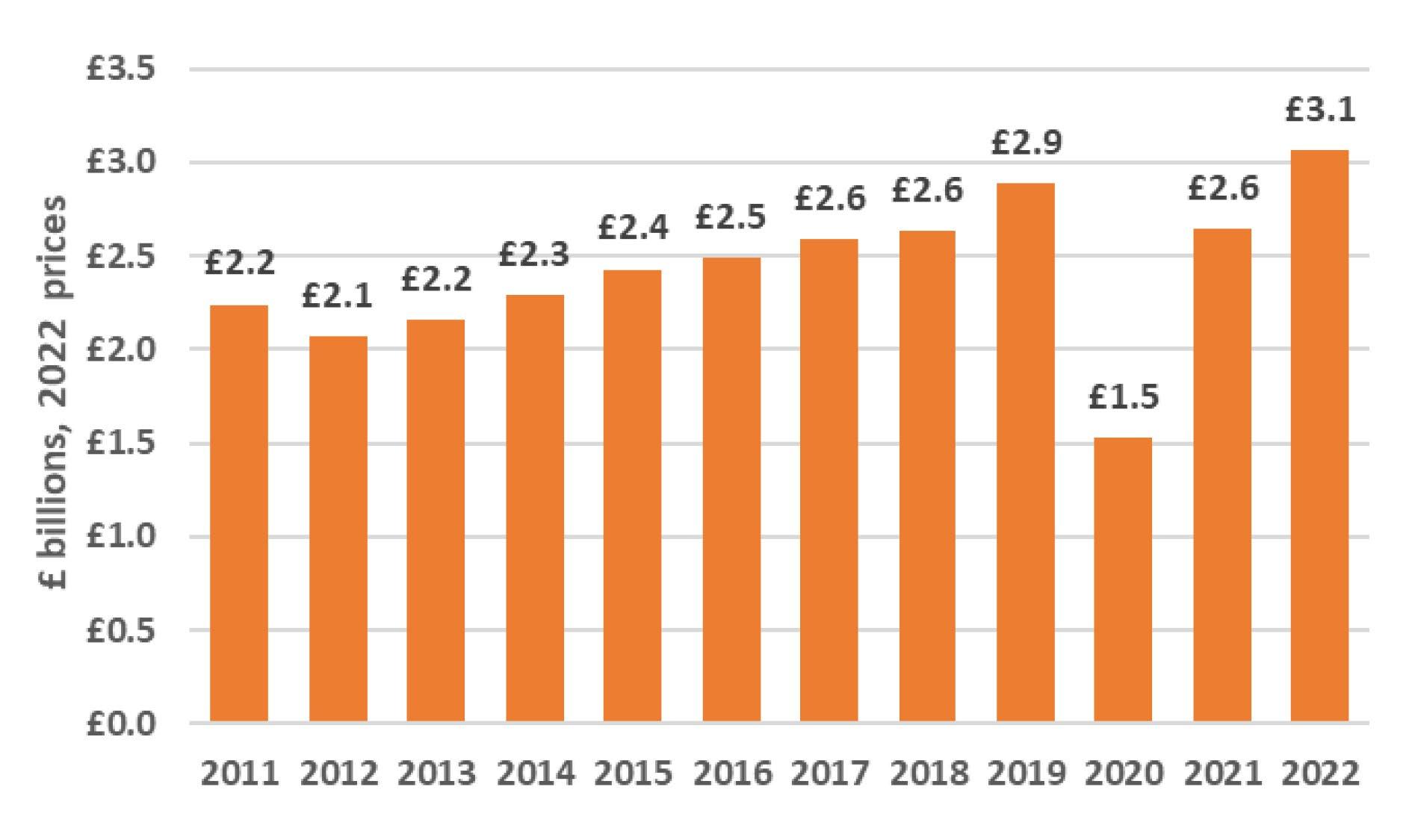

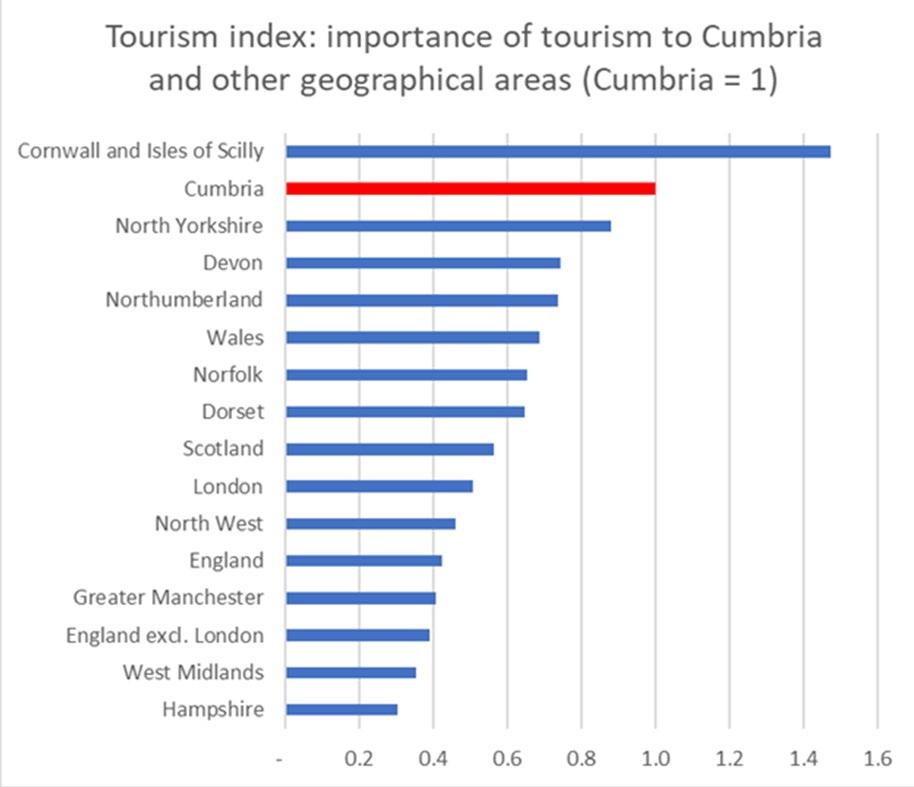

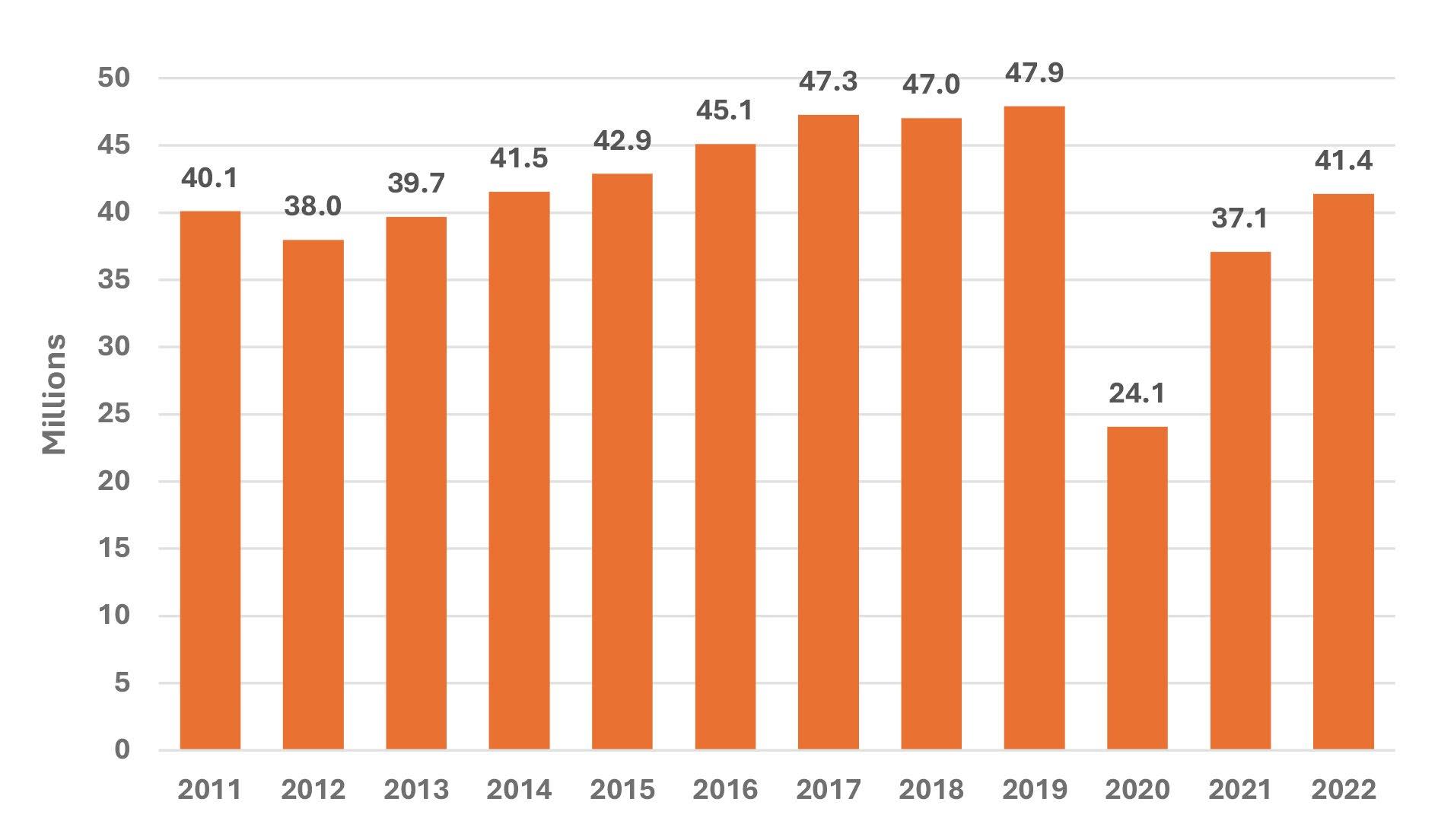

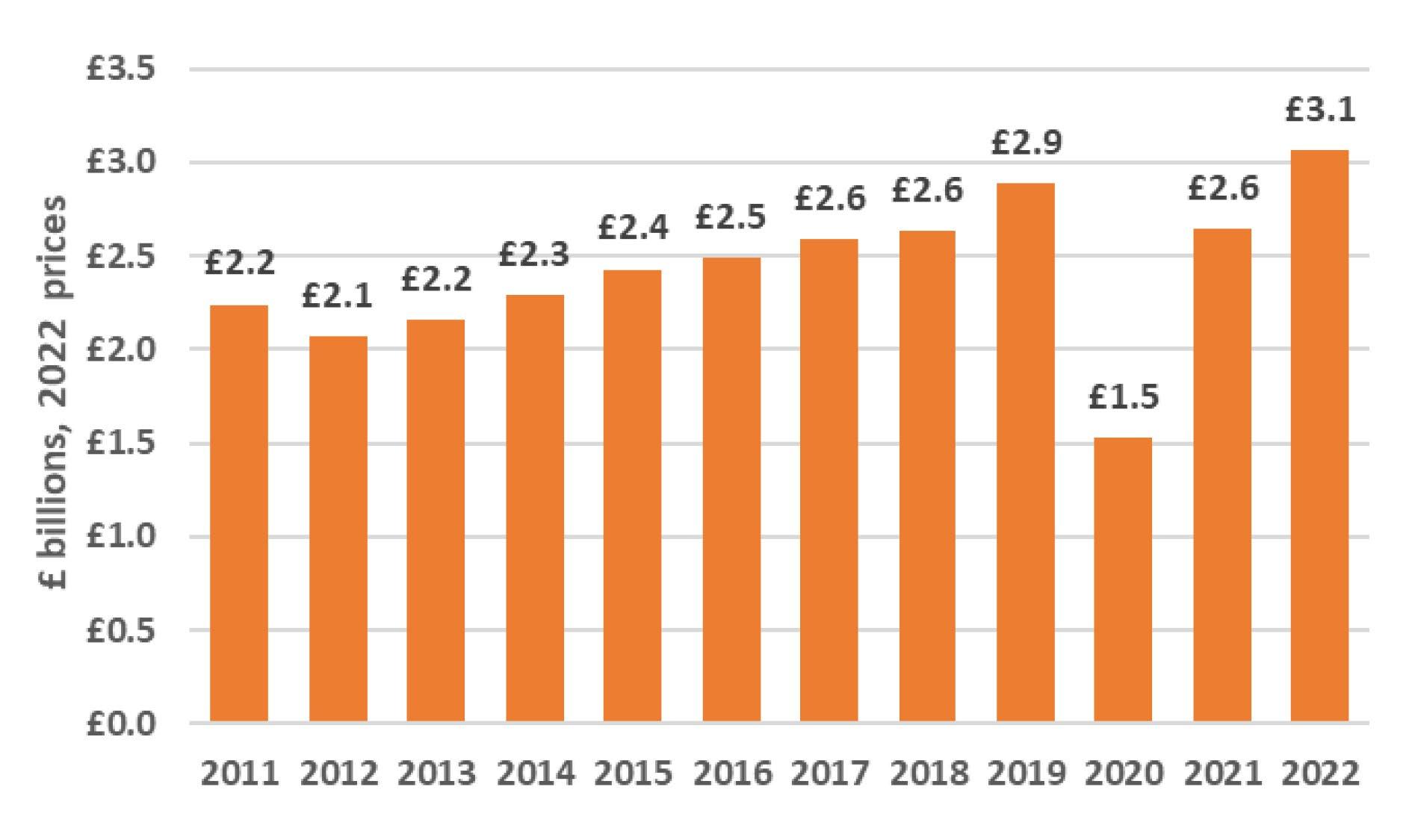

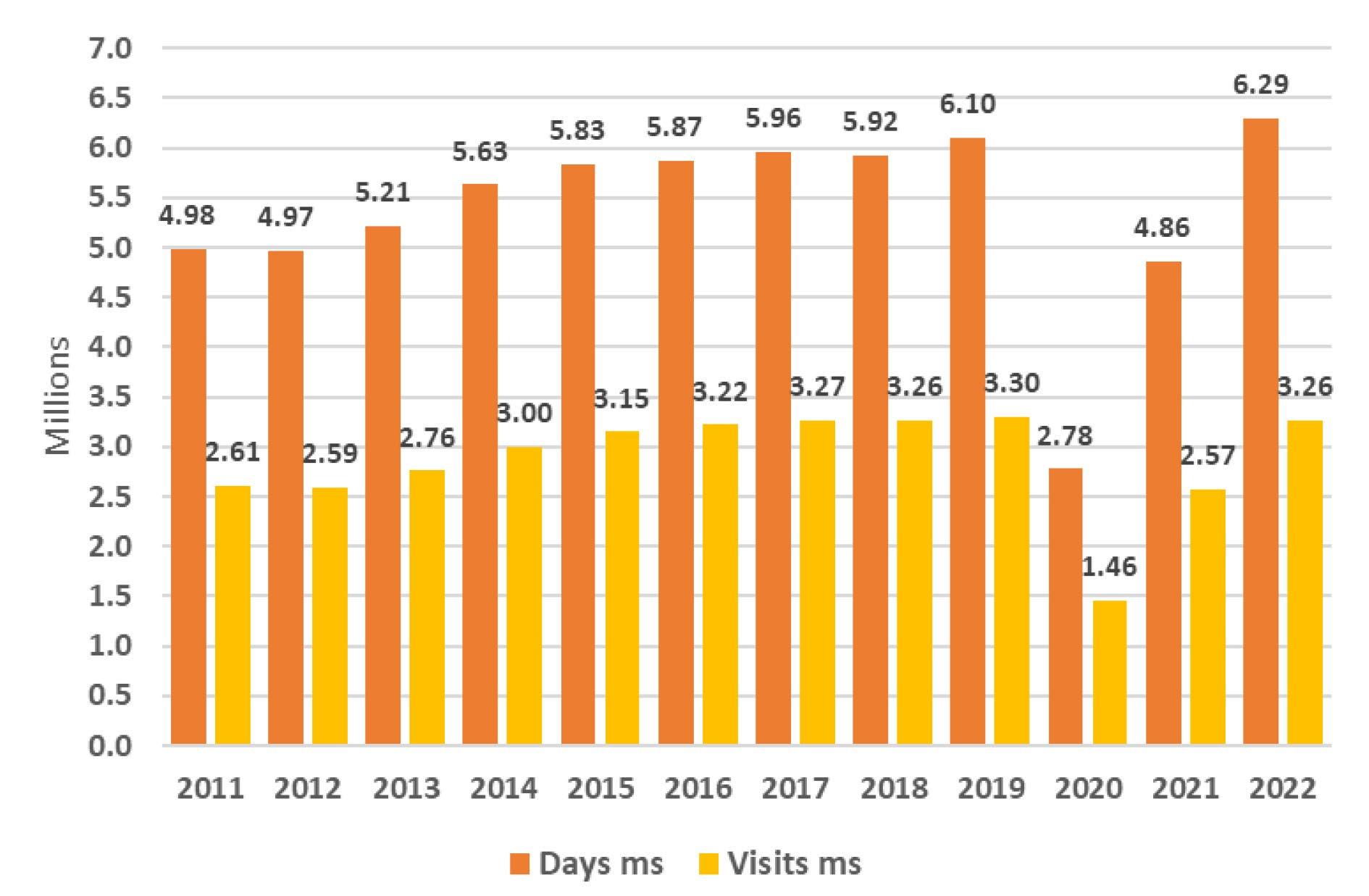

Volume, value and origin of visitors

1. Cumbria has a large and important visitor economy. In 2022, 41 million visitors generated around £4.1 billion of total spend in the economy including multiplier effects. This supports £1.2 billion in direct GVA and overall, an estimated 34,300 jobs directly (FTEs).

2. Taking account of supply chain and multipliers, visitor economy spend supports an estimated 43,600 FTE jobs (19% of the county’s total) and around £1.6 billion in GVA (13% of Cumbria’s total in 2021).

3. In terms of jobs supported, the visitor economy is the largest source of employment in Cumbria and is one of the key planks of the economy.

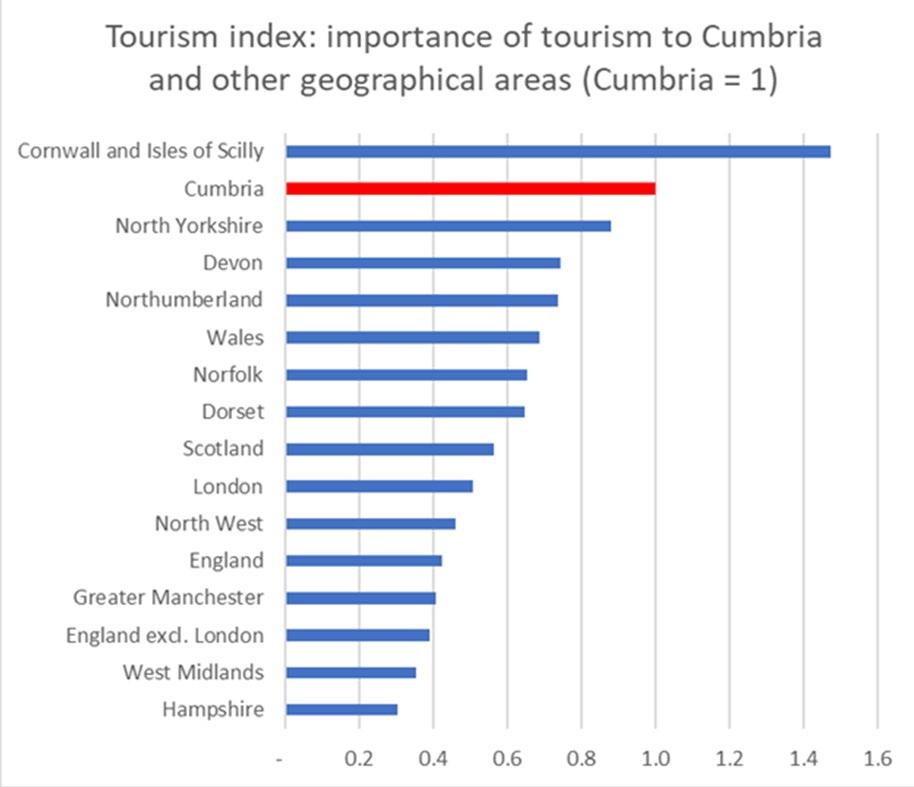

4. The relative importance of the visitor economy varies widely across Cumbria and is more important in the Lake District, where there are fewer alternative industries.

5. The visitor economy is yet to recover to pre-Covid levels.

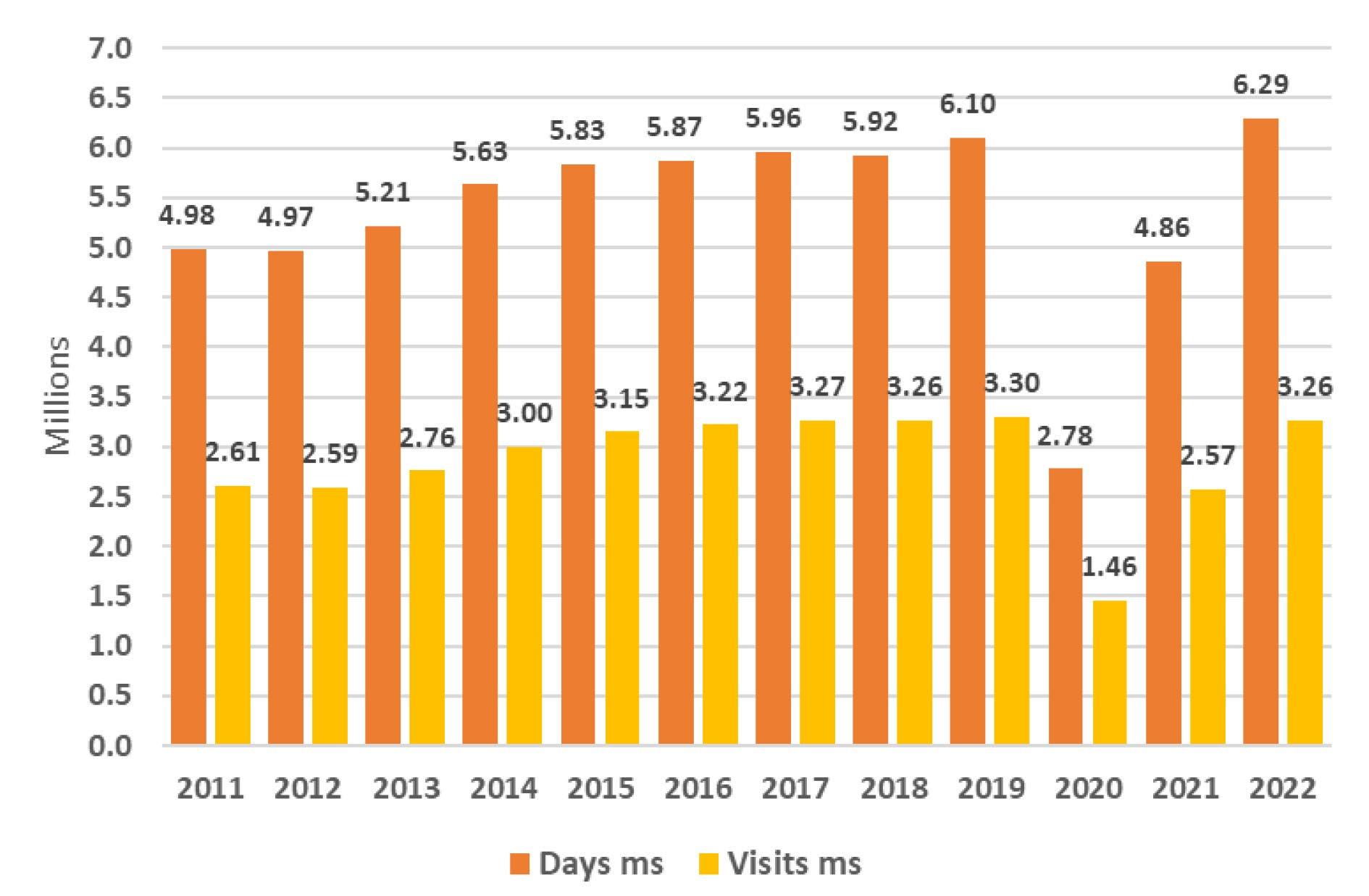

6. The 8 million overnight visitors in 2022 account for 43% of all tourism days and 54% of all tourism spend. The share of overnight visitors in total days and spend has risen since Covid and overall numbers are up on pre-Covid levels, in part driven by a strong increase in serviced accommodation. Although spend has risen, costs have also increased, leading to a squeeze on profitability.

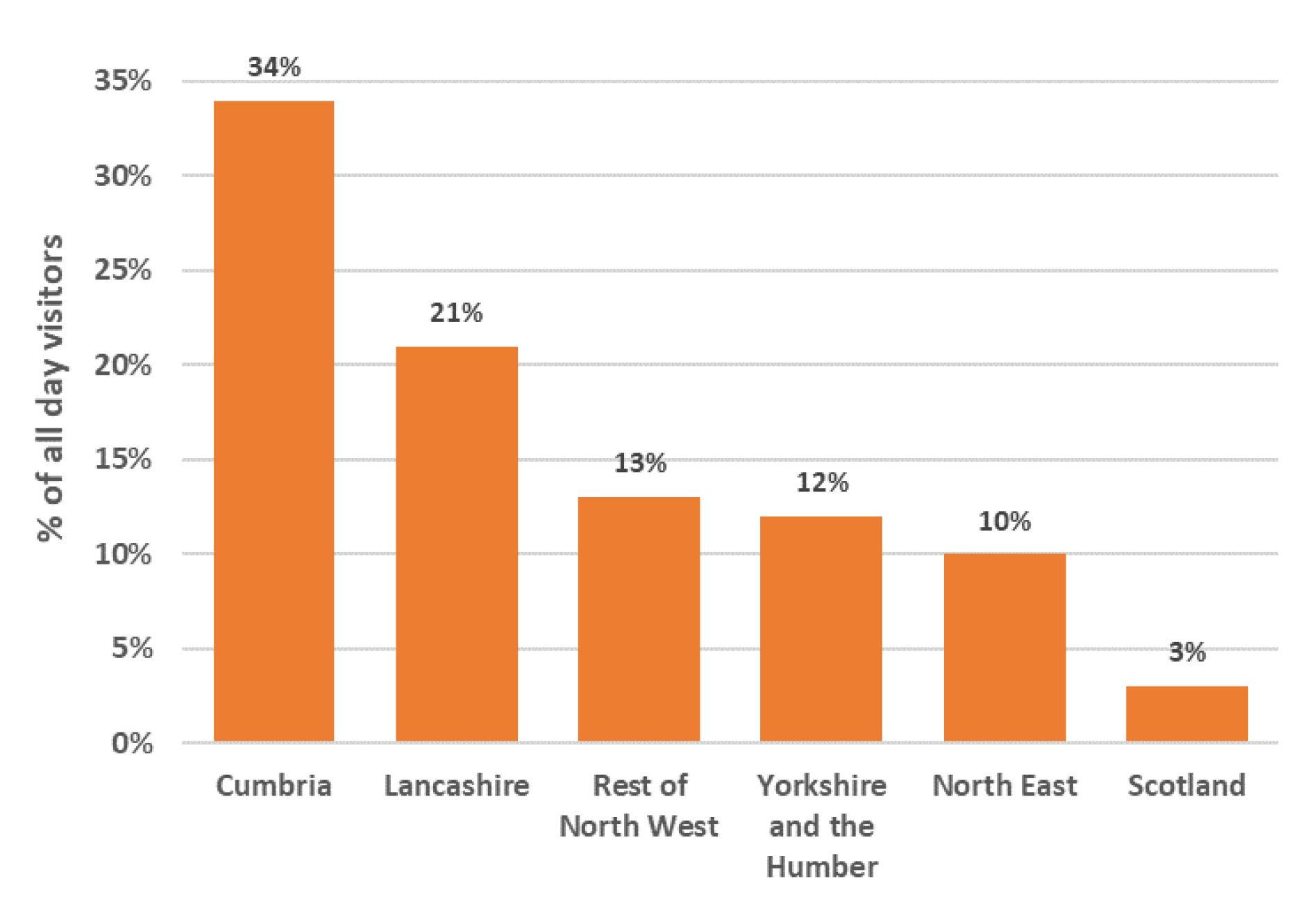

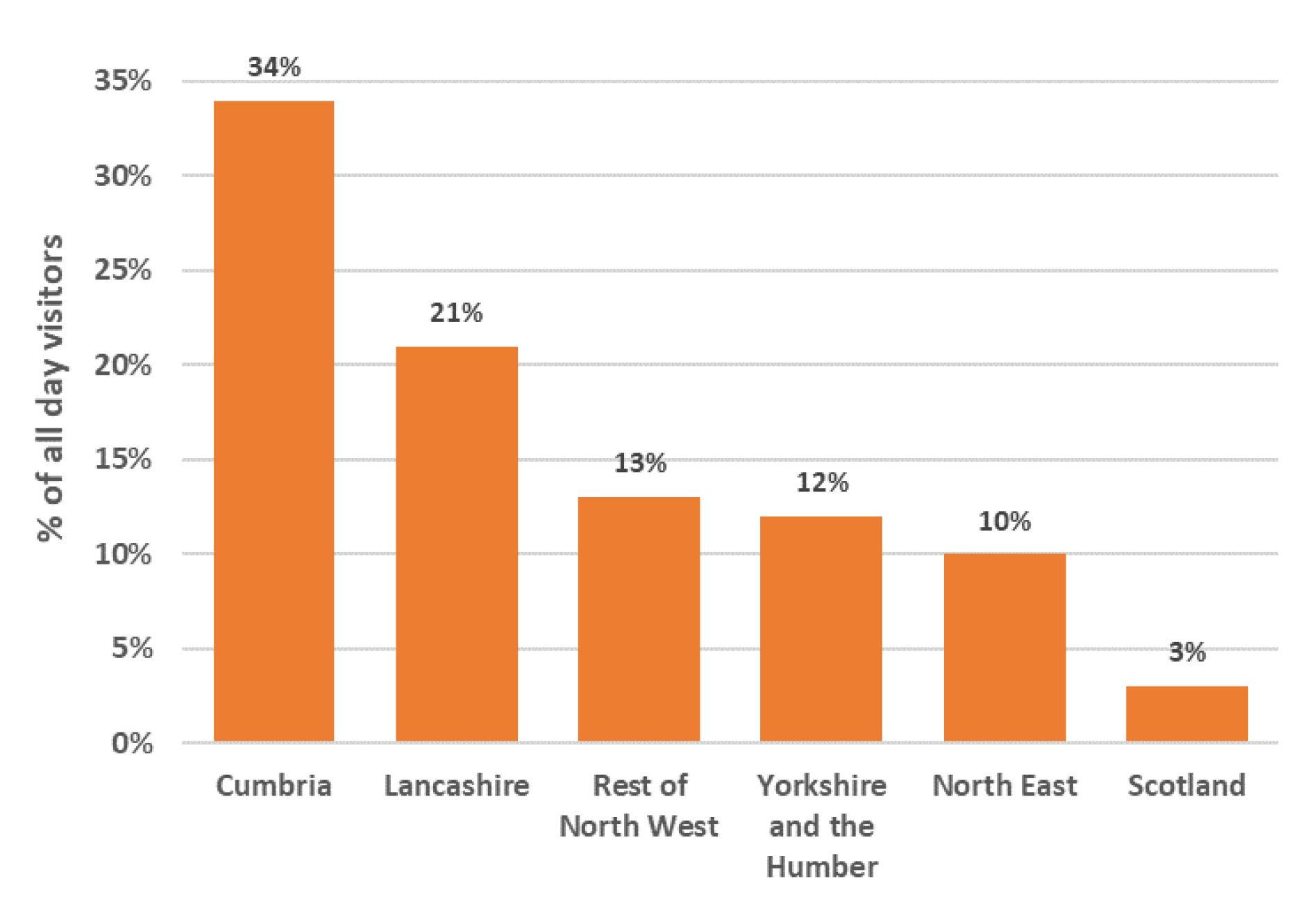

7. Overnight visitors to Cumbria come from across the UK as well as internationally. There is, however, a strong north of England focus. In 2022, two-thirds of all overnight visitors came from either the North West, the North East or Yorkshire and the Humber.

8. The 33 million day visitors in 2022 accounted for 80% of all visitors, 57% of all days, but 46% of all spend. On average spend per day is a third less than overnight visitors. Day visitor numbers remain 16.5% down on pre-Covid levels.

9. As of 2022, international visitors accounted for around 3% of the total, which is significantly below the pre-Covid levels of 10% to 12%, but is showing signs of recovery (as it has been nationally).

10. The pattern of visitors in 2022 had shifted compared to pre-Covid, with an increase in the proportion of ethnic minority and younger visitors, as well as visitors from areas closer to Cumbria. It is not yet clear whether this shift will continue.

11. A significant proportion of visitors (14% in 2022) included someone in their group with a health issue or disability.

25 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

Nature of visits

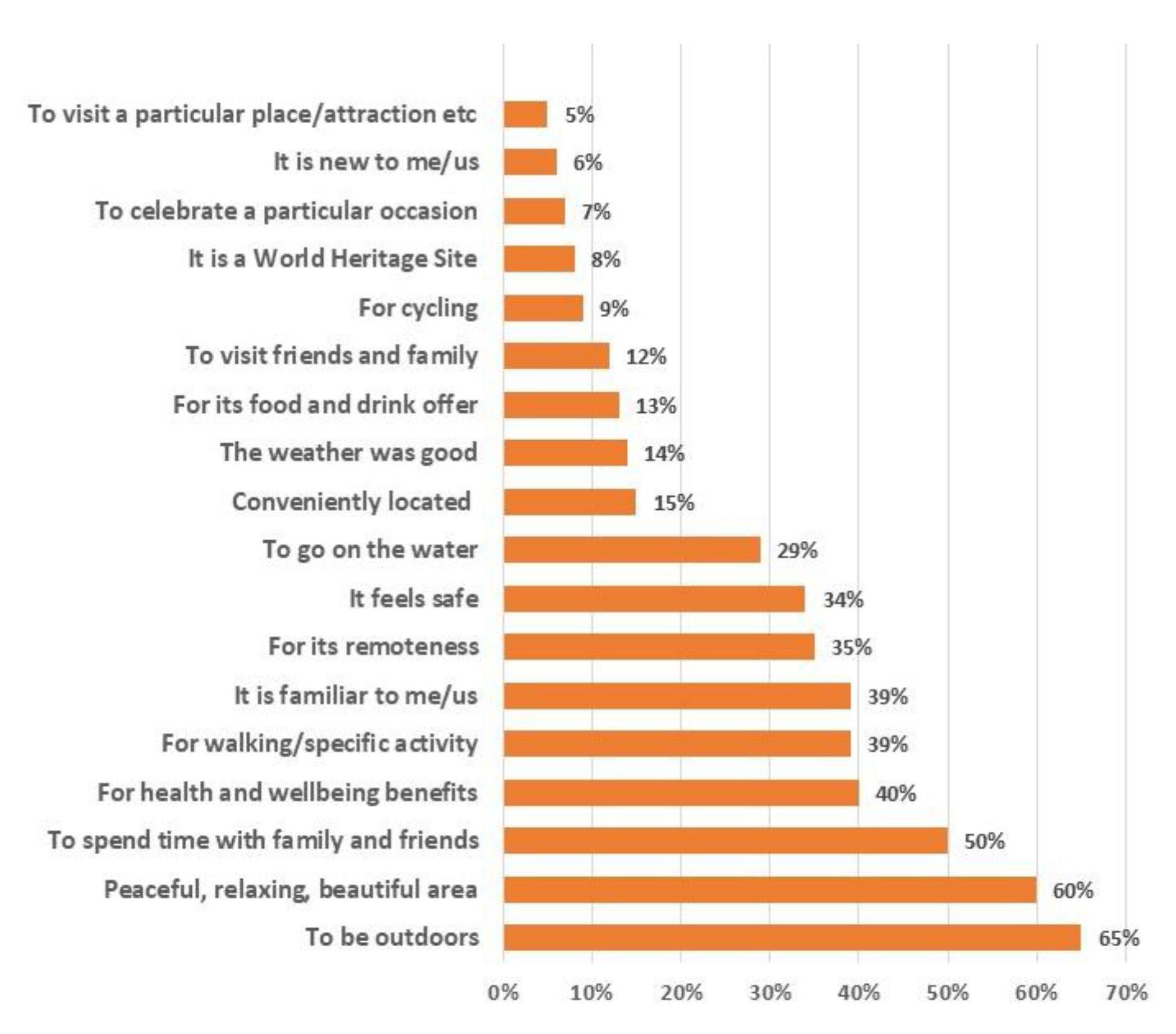

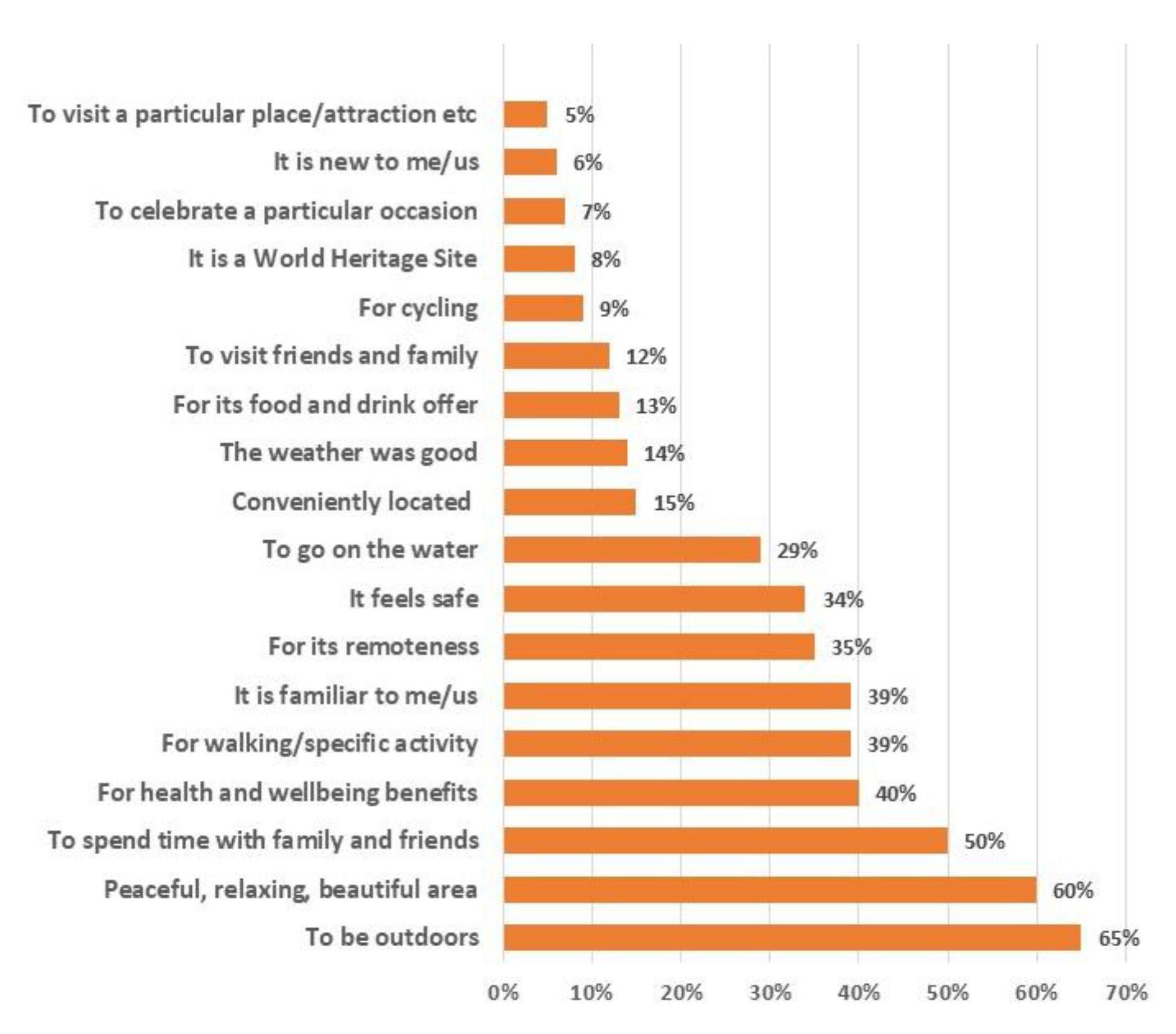

12. There is a clear and consistent pattern as to why visitors come to Cumbria: for the landscape (66%) or to be outdoors (65%); as well as the area’s peace/beauty/relaxation (60%); for the health and wellbeing benefits of walking (40%); its remoteness and feeling of safety (35%); and to go on the water (29%). Broadly the motivations have stayed consistent over time.

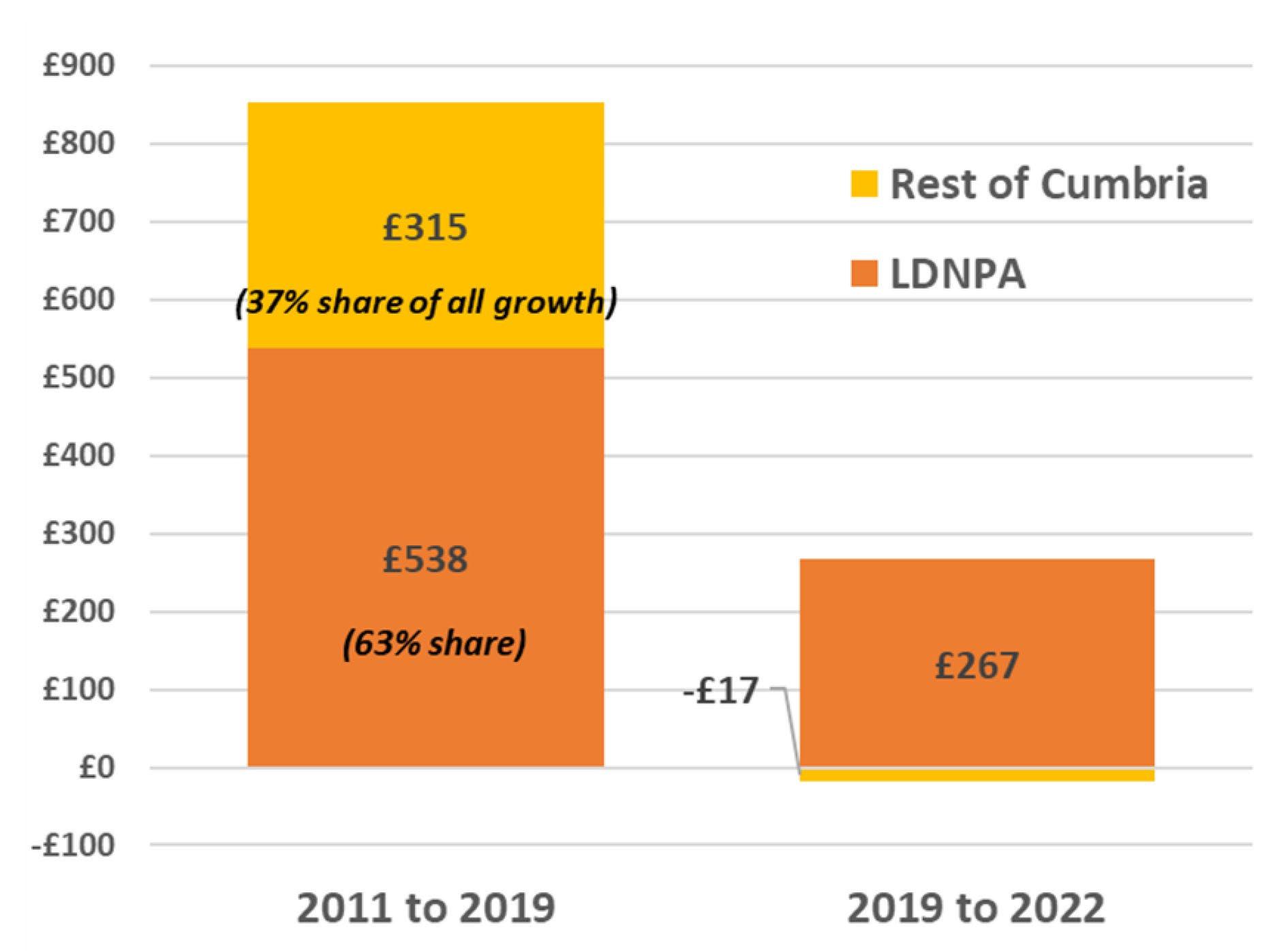

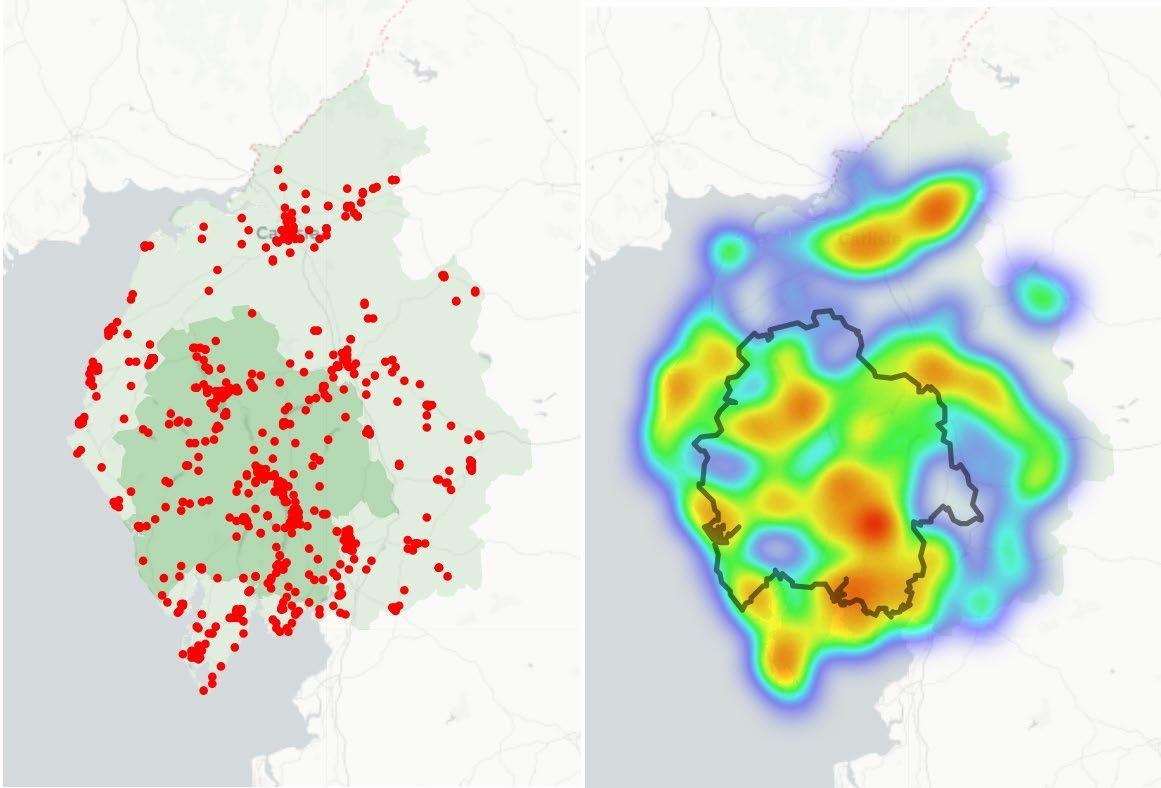

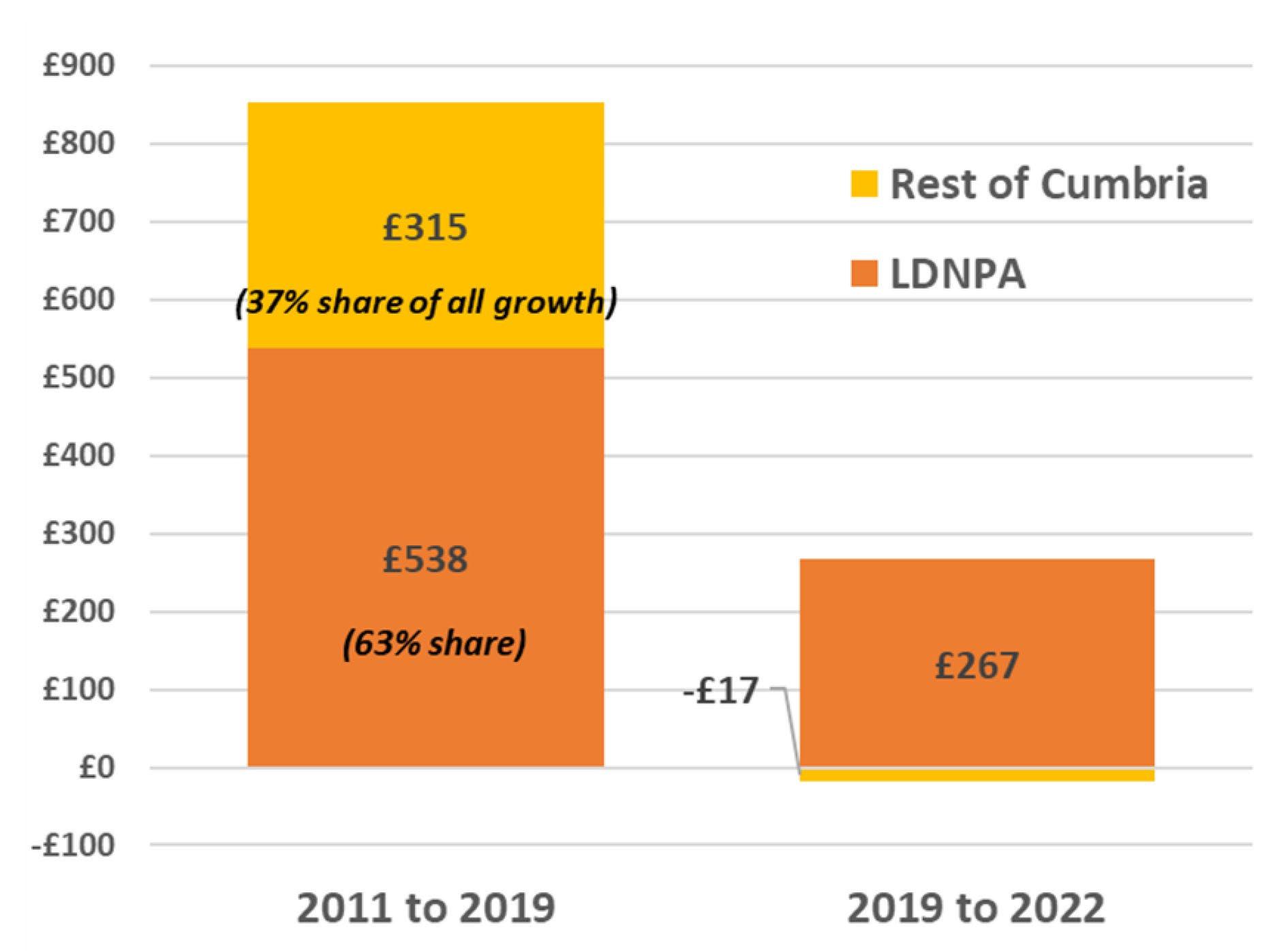

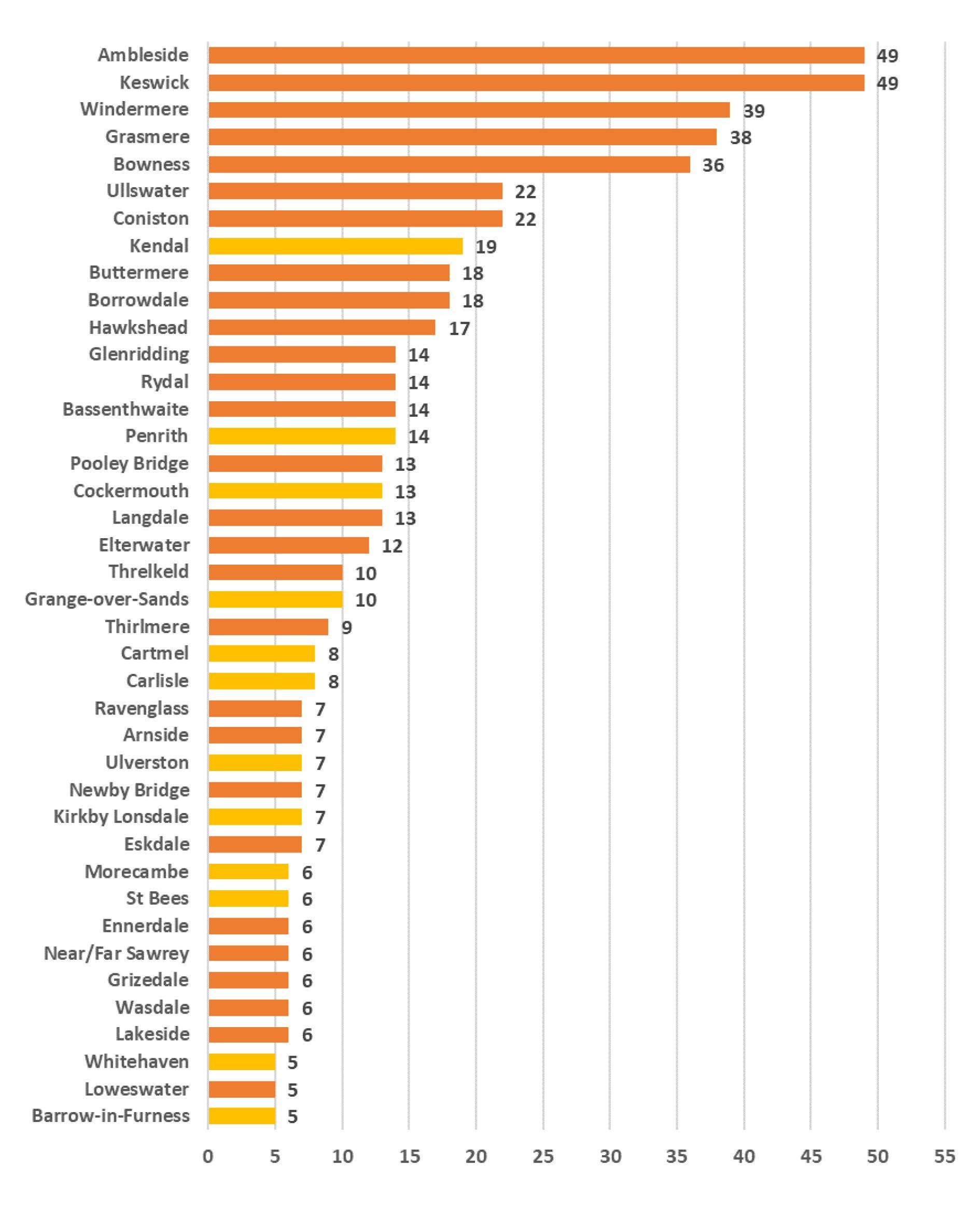

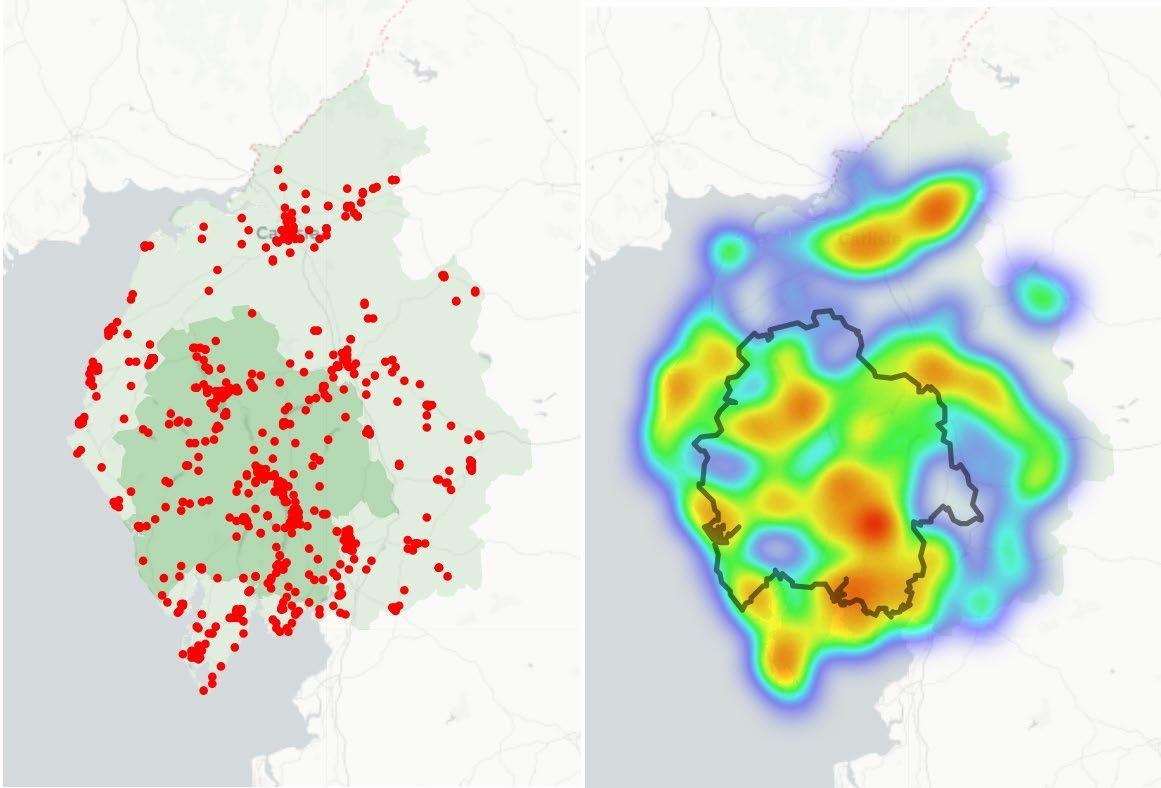

13. Within Cumbria, the Lake District National Park (LDNP) accounts for roughly half of tourism activity. In 2022, tourism in the LDNP accounted for an estimated 53% of all spend across Cumbria, 44% of visits and 50% of days.

14. The share of the visitor economy in Cumbria outside the LDNP area has changed over the past decade. Prior to Covid, there was a slight decline in the share of spend, visitors and days occurring outside the LDNP area. However, there was significant absolute growth in the visitor economy in both the LDNP and the rest of Cumbria. Post-Covid, although there has been a recovery in the Lake District, the rest of Cumbria has seen relatively poor performance.

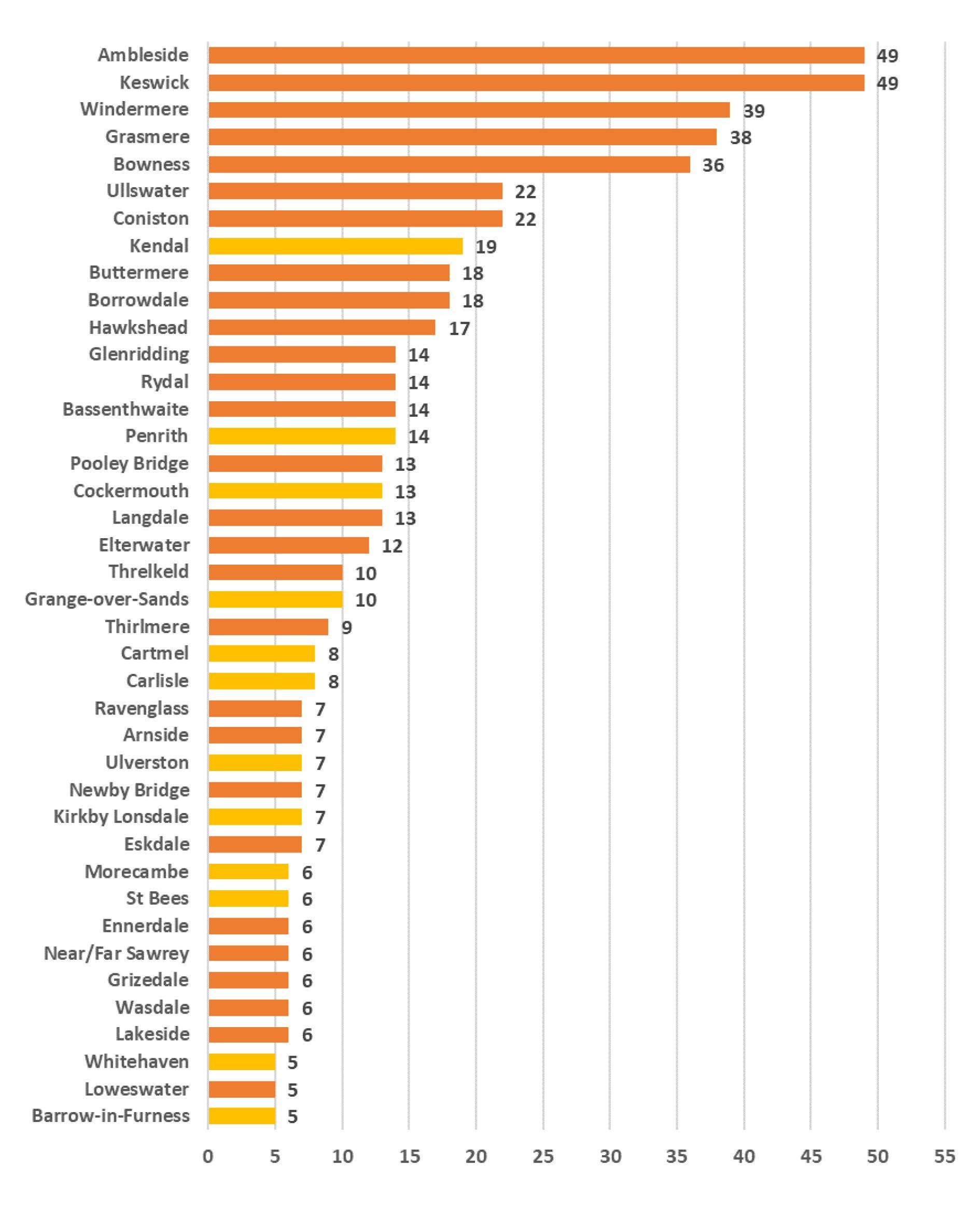

15. Visitors to Cumbria are concentrated in the perennially popular locations within the core parts of the Lake District (Ambleside/Windermere/Bowness/Grasmere and Keswick, then the lakes Ullswater and Coniston). Towns surrounding the LDNP make up the next tier of visitor locations (Kendal, Penrith, Cockermouth and Grange/Cartmel/Ulverston, Kirkby Lonsdale/Sedbergh/Kirkby Stephen, etc).

16. There are many areas of Cumbria with relatively few visitors. Carlisle, the largest settlement in Cumbria, is a city with a major castle, Tullie House Museum and Art Gallery, local food/drink and retail offer, and archaeology and heritage. It is relatively less visited, as is Hadrian’s Wall and the Cumbrian coast.

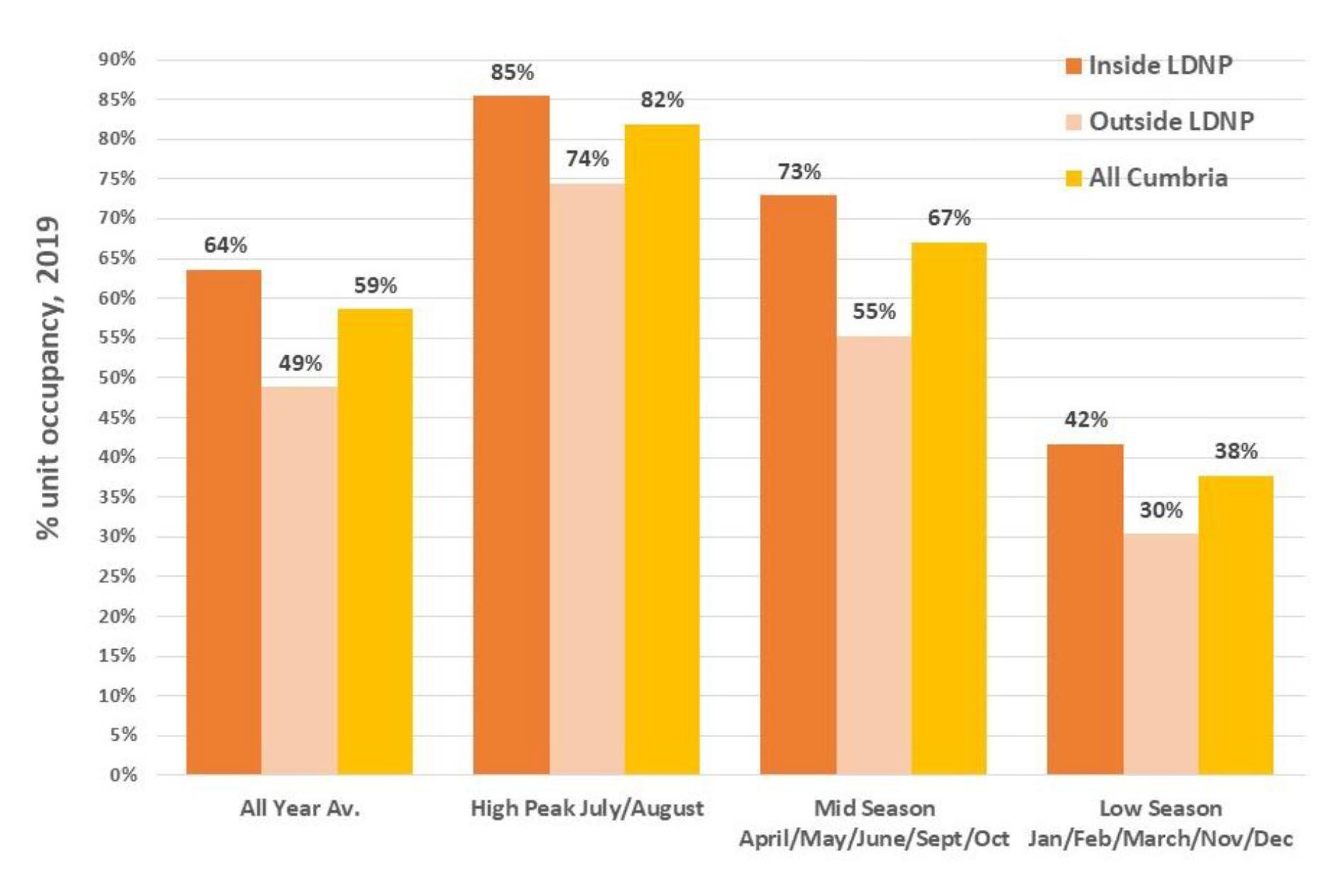

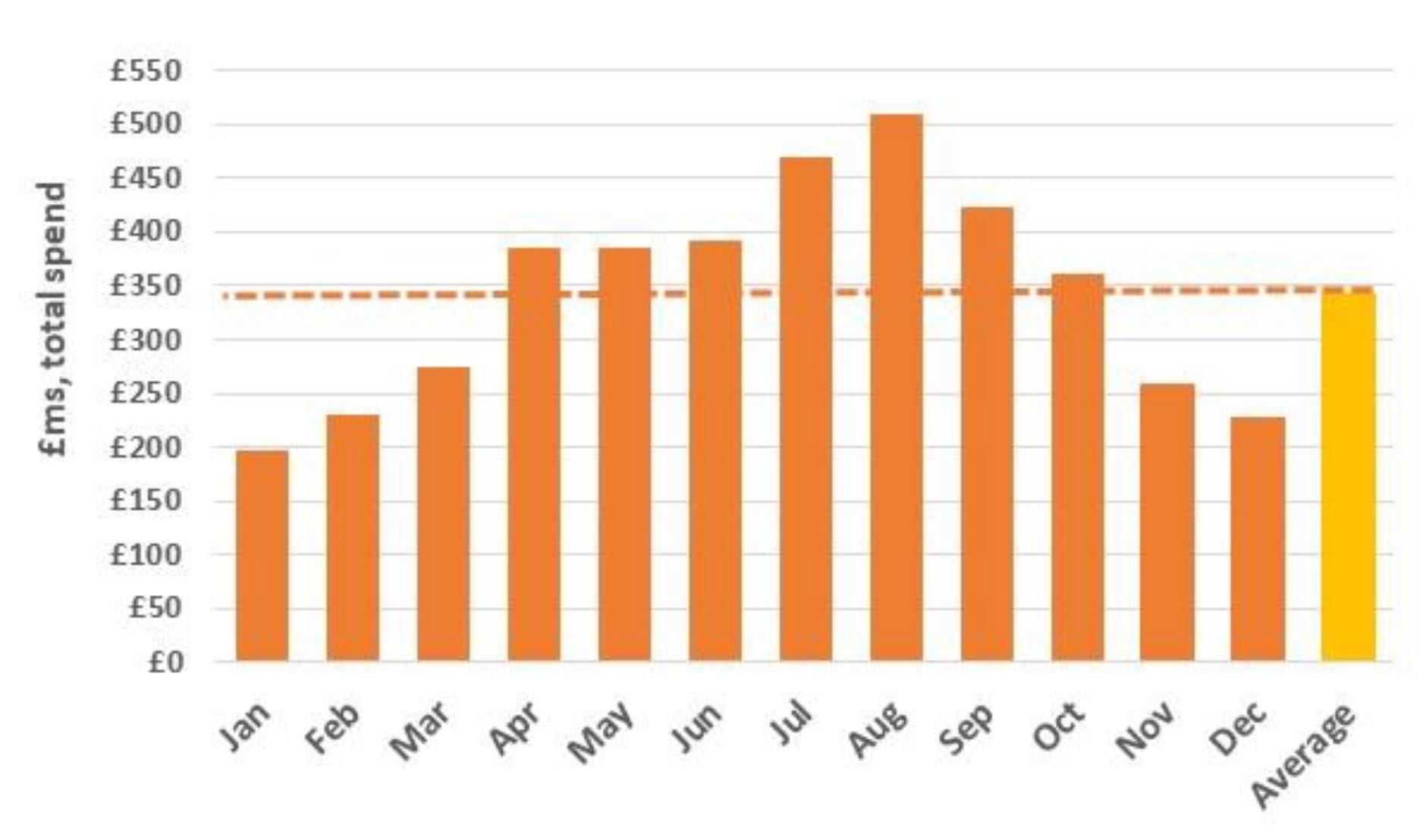

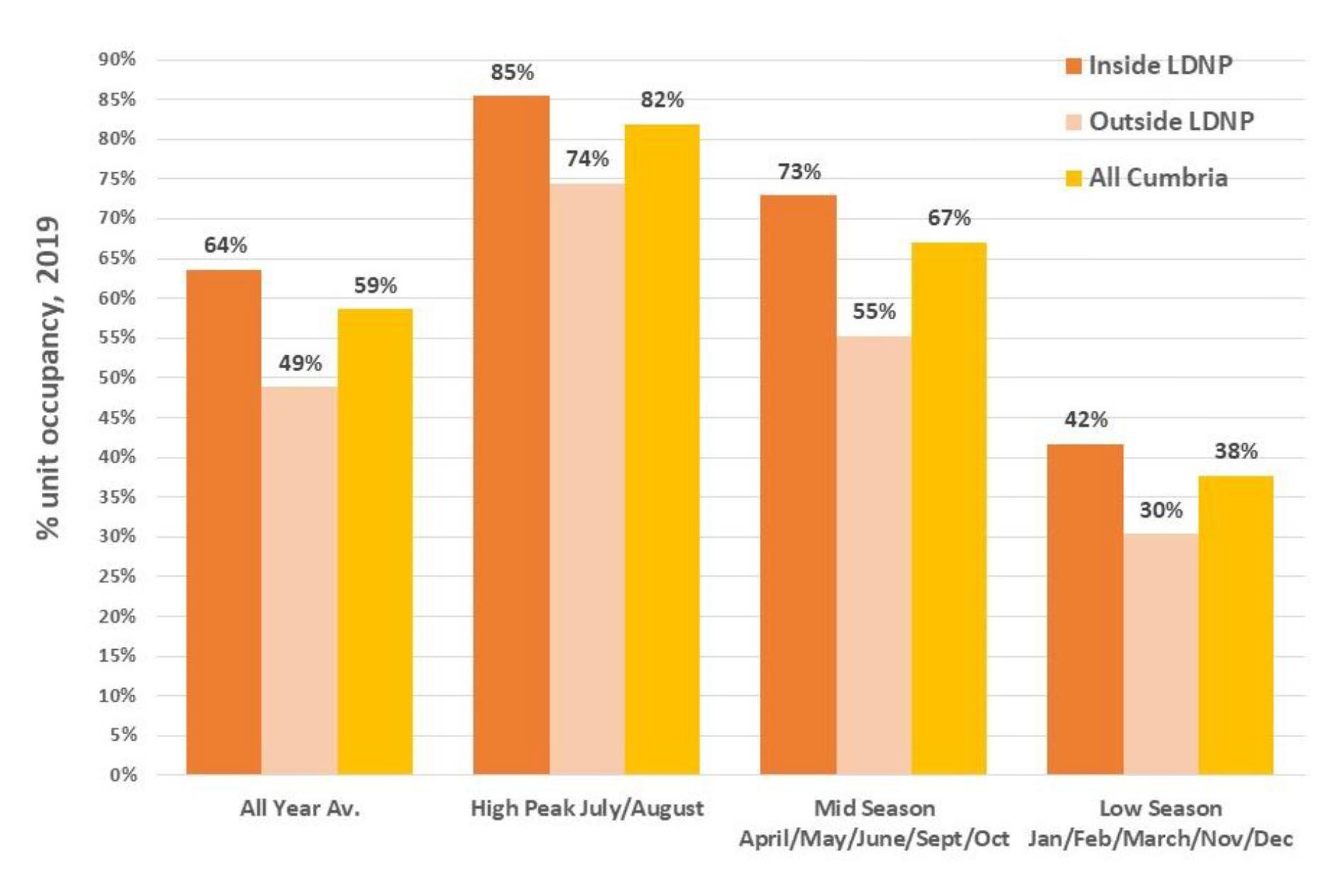

17. Visitors come to Cumbria all year-round, and there is no closed or entirely off-peak season. However, tourism - especially overnight tourism - remains seasonally driven by family holiday availability, accommodation availability, the weather and the outdoor focussed nature of many visitors. The seasonality of tourism is particularly pronounced outside the Lake District National Park.

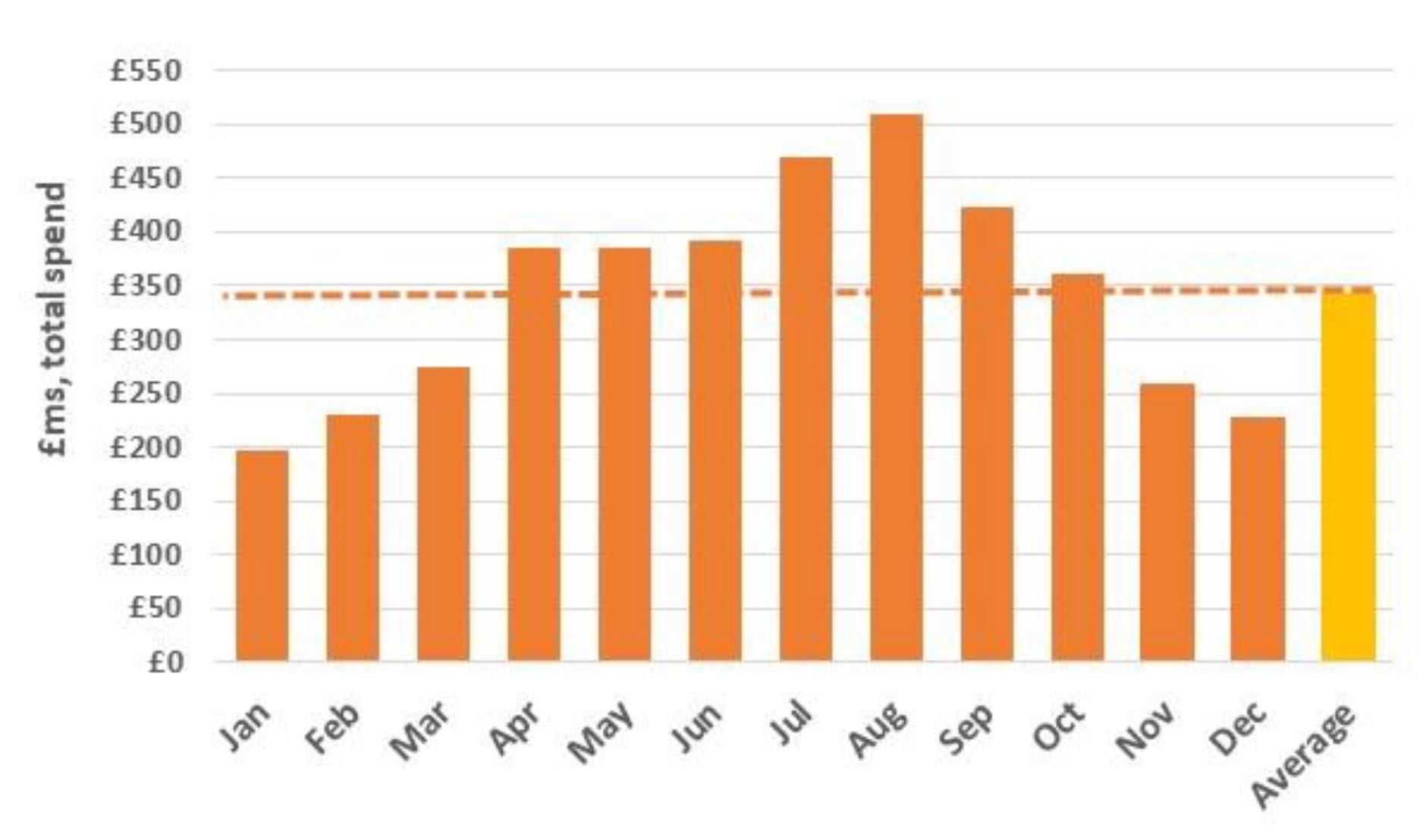

18. A 10% increase in visitor spend in each of the off-peak months and 5% in the shoulder months outside the peak months for spend (July and August) would increase overall spend, based on 2022 figures, by around £255 million or 5%.

19. Most visitors still come to Cumbria by private vehicle. In 2022, an estimated 91% arrived by private vehicle, up from 86% in 2018 and 81% in 2015 (in part due to the drop in international visitors).

20. Once visitors have arrived in Cumbria, there are shifts in the modes of travel used. Although private vehicles remain the dominant form of transport (around 90% using car/van/ motorbike/motorhome), there is significant level of “active travel” with 57% of visitors travelling around on foot and 9% by bike/e-bike.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 26

The sector and infrastructure

21. Cumbria’s visitor economy largely consists of small, independent and local businesses. Cumbria Tourism (CT) provides a focus for businesses to come together and work collectively. It represents 4,500 member businesses or nearly 20% of the 23,100 businesses across Cumbria in 2022. CT is also the Local Visitor Economy Partnership (LVEP) recognised by VisitEngland as the county’s lead tourism body and a conduit for visitor economy businesses and locally based associations and partnerships.

22. Access to the people and skills necessary to deliver services has been the biggest challenge for visitor economy businesses in Cumbria in recent years, mirroring national challenges across the hospitality sector, but being even more acute in Cumbria. The issues in Cumbria, especially in the Lake District National Park, are also connected with transport and housing.

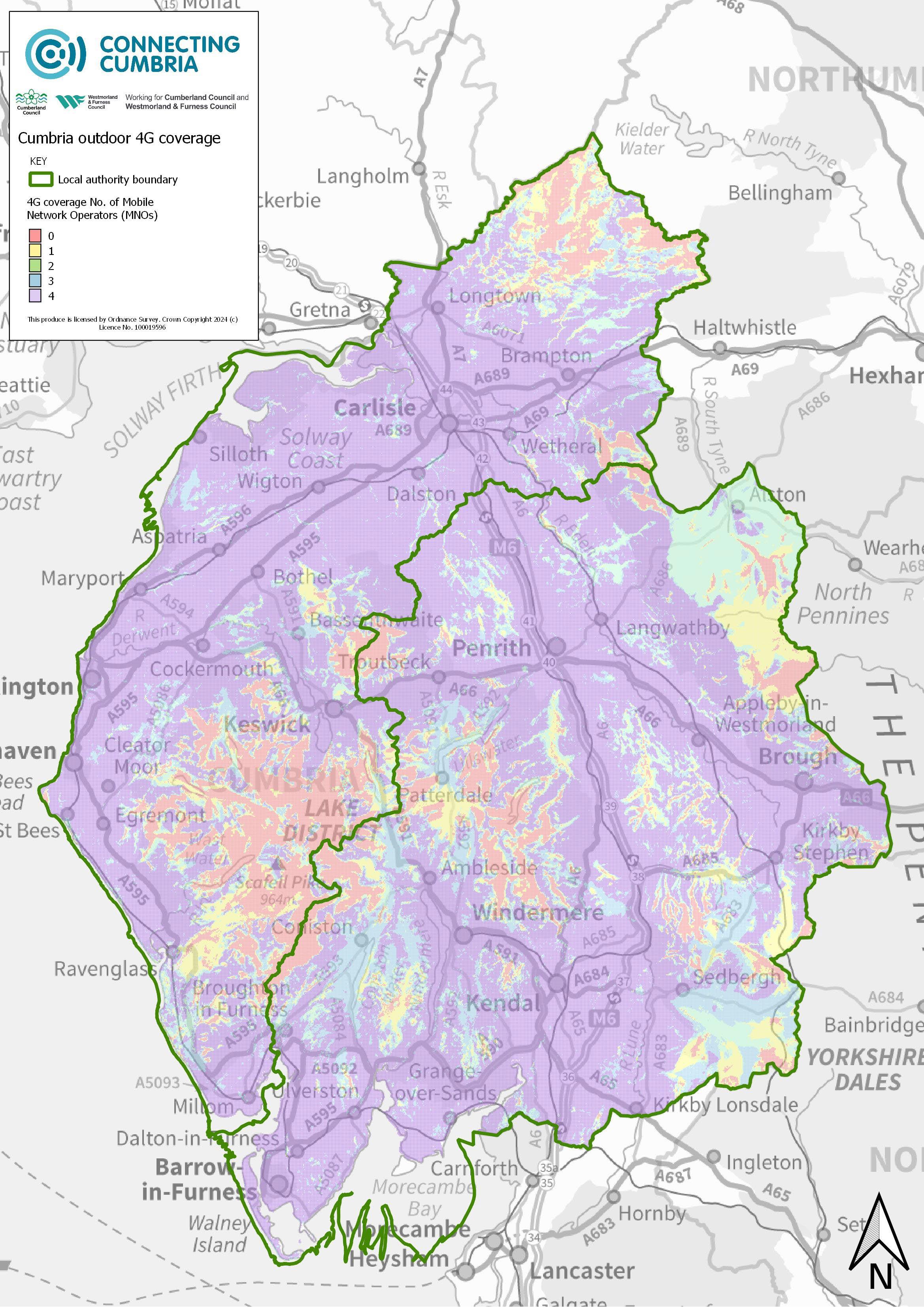

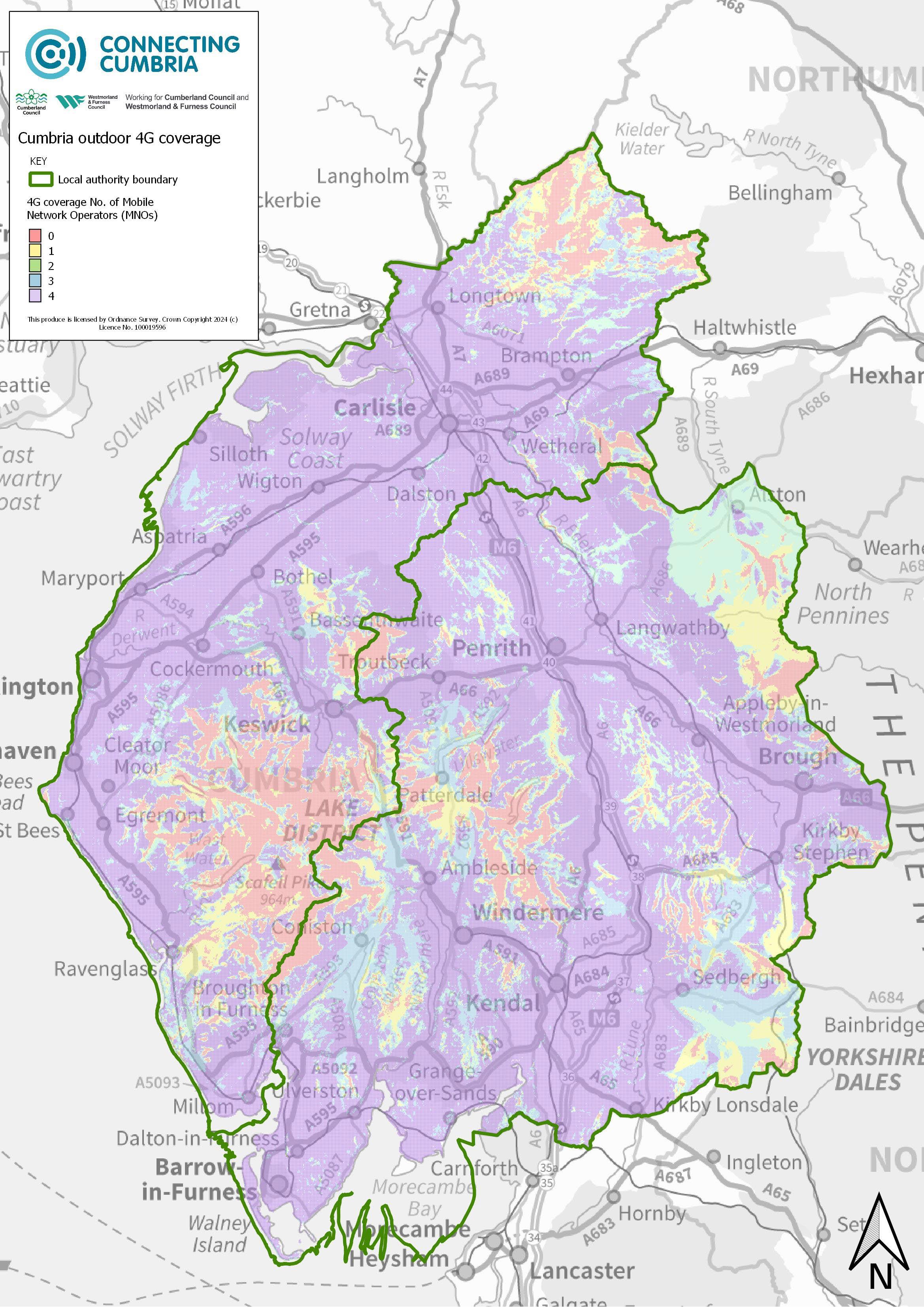

23. Visitors increasingly expect and demand universal access to extremely high quality, reliable and consistent digital connectivity. Cumbria has historically had large areas with poor access to digital services due to its rural nature and typography.

24. There has been good work to support improvements in digital infrastructure, both fixed line broadband and mobile. However, there is still significant work to do to reach the most rural areas with comprehensive digital connectivity, as well as seeking to meet the increasing demand for 5G services. Therefore digital connectivity remains an issue for the visitor economy (for both business and visitors).

25. There are significant investments either planned, or already underway, that will provide opportunities for the visitor economy:

• There are plans, not yet funded, to improve rails service along the Lakes Line to Windermere and the Coastal Line from Carlisle to Barrow along the West Coast.

• Major investments are planned and, in some cases, underway in many town and city centres supported by the Borderlands Inclusive Growth Deal, Town Deal, Future High Street Fund and the Levelling Up Fund. A significant part of the planned investments are aimed at improving town centres and developing new facilities and attractions (for the local population and visitors alike).

• Other important visitor attractions, such as Tullie House Museum and Art Gallery in Carlisle, are planning substantial upgrades.

• A range of new and improved visitor trails and cycle ways have been developed or are planned, including the designation of the Coast to Coast Walk as a National Trail.

• The Carlisle Southern Relief Road will improve accessibility by road (although this needs to be balanced against the sustainability drivers for the visitor economy).

• The Cumbria Digital Infrastructure Strategy and Borderlands 5G Innovation Regions area will both look at opportunities to improve digital connectivity and encourage both commercial and public investment.

27 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

2.2 SWOT ANALYSIS

STRENGTHS

Assets

• Strong brand awareness (especially of the Lake District) and positive brand associations

• Unique natural cultural environment –landscape, coast, two World Heritage Sites, a Global Geopark, two National Parks and three National Landscapes, etc

• The lakes, tarns, rivers and sea offering opportunities for water activities (sailing, kayaking, wild swimming and paddle boarding) with steamer/ferry services on 4 lakes

• Space, lack of development, openness, dark skies

• Visitors come to Cumbria all year round; there is no closed or entirely off peak season

• Well positioned in terms of outdoor activities –walking, cycling, water sports - and so “green”, health & wellbeing

• Breadth and quality of our local food and drink offer

• Rich range of cultural assets and attractions –historic houses, archaeological sites, the City of Carlisle (castle, Tullie House and the Cathedral), old towns and villages, traditional country and farming shows

• Good health and wellbeing attributes benefitting both visitors and communities

• High quality hotels and facilities offer

• Wide range of accommodation offers and recent upgrade in facilities

• Key attractions; internationally and nationally known

Markets

• Loyal and repeat visitors from the UK

• Recent attraction of new domestic market segments (especially from relatively local areas across the North of England) and increased % of younger audiences

• Proximity (in terms of drive times) to large urban conurbations (central belt in Scotland, North East, West Yorkshire and Manchester and Liverpool City Regions)

Sector working and infrastructure

• A flexible and adaptable sector – many small and family businesses

• Good cross-sector working and public-private links in the visitor economy

• Cohesion through local plan, LDNPA engagement, World Heritage Site organisation, close communities

• Base of transport infrastructure to build on

Markets/visitors

WEAKNESSES

• Peripheral market for most international visitors –limited awareness

• Poor awareness of ‘hidden gems’

• Limited visitor numbers to less core places outside the LDNP (e.g. Carlisle), overly concentrated in a few more well-known locations

• Recent increased reliance on the North of England as a core market for staying visitors

• Lack of integrated ticketing, e.g. attractions, transport and parking

Business/sector

• Serious staffing shortages

• Poor image for careers – low wage and perception of weak career offer

• Communication/messaging disparate, lack of one voice for the sector

• Businesses with post-Covid damaged balance sheets and with squeezed profitability making it harder to invest

Facilities

• Lack of investment in major transport and infrastructure projects

• Poor digital infrastructure in parts of Cumbria, especially very rural areas – limited capacity for 4G and limited investment into 5G

• Cumbria, especially the LDNP, is currently seen as a challenging area for investment into new mobile infrastructure

• Lack of grid infrastructure for EV chargepoints

• Poor public transport offer within parts of the Lake District and elsewhere in Cumbria (e.g. Eden Valley)

• Quality and visibility of accessibility offer

• Car parking provision in more well known locations and visibility of capacity

• Heavy visitor usage over years in some locations and facilities, leading to degradation and need for re-investment

• Limited higher quality accommodation offer in West Cumbria and Barrow area

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 28

OPPORTUNITIES

Assets

• Under visited and exploited Hadrian’s Wall area/Carlisle and sites with historical links

• Under visited areas of coastline/landscape/western lakes

• Under visited attractions with historical, military and industrial links (from Barrow to Maryport and Carlisle)

• Planned investment in visitor facilities and attractions in Barrow, Carlisle, Maryport, Millom and Whitehaven

• Under used accommodation and facilities outside peak season – opportunity to grow productivity by extending the season via events, etc

• Extend and improve offer for cycling and other outdoor activities

• Linkages to existing and new attractions in surrounding areas (Eden Project Morecambe, Kielder Forest, Hadrian’s Wall Northumberland, other parts of the North Pennines National Landscape, Yorkshire Dales, South Scotland forests, etc)

Markets

• Returning international markets to the UK

• Proximity to areas with international profile and gateways: Manchester, Liverpool (with raised profile as a result of Eurovision) and Scotland

• Low levels of visitation from higher earning London/South East markets

• Opportunities to increase inclusivity and accessibility (Purple Pound)

• Building on health & wellbeing offer – “Natural Health Service”

• Build reputation as a low carbon sustainable rural tourism location

• Continue to grow younger market

• Strong interest in business investment opportunities by private sector

• Eden Project North

• Links to staycation and live, work and study offer

• Significant growth in Advanced Manufacturing (BAE Systems/ Nuclear) could lead to growth in accommodation demand, business tourism.

Sector working and infrastructure

• Growing the local employment and career offer

• Working in partnership to organise and address issues

• Experience and capability growth/creation – career and education pathways into visitor economy

• Develop lower carbon and lower energy businesses

• Improved digital connectivity through fixed line broadband and mobile infrastructure

• Innovation opportunities

• Develop Cumbria as a Centre of Excellence for Hospitality Training

Funding

• Availability of Borderlands Place Programme (three towns), approval of Town Deal (four towns/cities), Future High Street Fund (one town) and Levelling Up (one town) creating opportunities for improvement of key destinations surrounding the Lake District

THREATS

Markets/visitors

• Squeezed UK incomes and cost of living crisis reducing visitor numbers and/or spend per visit

• The right balance of tourism numbers versus sustainable rural landscape management

• Global competitive market – we need to be ‘first movers’

• For international visitors, the new ESTAs, costs compared to Europe and tax-free shopping affecting the competitiveness of UK

• Shift to more EV owners and limited local charging points

• Reliance of car-based visits at odds with desire to promote low carbon tourism

Business/sector

• Increasing cost base in terms of staff and energy/other costs

• Continued labour workforce shortage

• Growth of second/holiday homes and Airbnb, plus property values driving lack of affordable housing for staff

• Lack of community support and resistance to development in some places?

Facilities and environment

• Damage to landscape, nature/ biodiversity and tourism offer/ facilities

• Effect of climate change and adverse weather on the environment, on facilities and on the visitor experience (wetter winters, flooding, droughts, etc)

• Concerns over water quality in lakes and other water bodies

• Local government funding for services

• Poor relative digital connectivity and capacity as usage and demand from visitors increases, as well as difficulty in attracting investment in areas with low numbers of yearround residential customers

29 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

VISION AND OBJECTIVES 3

3 VISION AND OBJECTIVES

Muncaster Castle ©Rob Duncalf 30

3.1 OUR VISION

The DMP has a long-term shared vision for Cumbria to ensure we retain our distinctiveness and competitiveness as a visitor destination:

“Famed for our world-class landscapes and culture, by 2040 Cumbria will be Britain’s most vibrant and sustainable rural destination, boasting a reputation for quality, welcome, and an adventure for everyone, bringing benefits for visitors, the economy, nature and our communities”.

This is a long-term and ambitious vision that builds on our strengths.

3.2 KEY OBJECTIVES FOR THE DMP

The following overarching objectives have been developed to address the opportunities and challenges faced by Cumbria’s visitor economy.

OBJECTIVE:

DRIVE ECONOMIC GROWTH

OBJECTIVE:

ENSURE A SUSTAINABLE & RESPONSIBLE VISITOR DESTINATION

OBJECTIVE:

ENSURE AN INCLUSIVE & ACCESSIBLE VISITOR DESTINATION

OBJECTIVE:

BE RESOURCED TO DELIVER

Increasing the value and productivity of Cumbria’s visitor economy

Supporting responsible tourism, benefitting the environment and vibrant communities

Ensuring all visitors can enjoy Cumbria as a destination

Supporting the sector to deliver world class experiences

One objective is about growing the value of the visitor economy to deliver the economic benefits outlined earlier by attracting visitors to stay longer, visit less well-known parts of the county and increase visits out of season.

The next objective is about positioning Cumbria as a leading sustainable and responsible tourism destination. This requires managing visitors as they journey to us and when they are here. It requires our businesses to develop their plans to offer low and zero carbon experiences in ways which inspire, excite and attract.

This will maximise visitors’ experiences, bring beneficial local economic impact and minimise their environmental impact. It will accelerate the reduction of the overall carbon footprint from tourism activity in Cumbria and catalyse sustainable choices at the same time as creating world leading experiences.

This objective follows through on the aspiration of the vision and will provide visitors with confidence and excitement to come - knowing they have had a low carbon, low environmental impact experience. Cumbria aspires to be a globally leading environmentally responsible destination, promoting a culture of understanding of the area to the visitor and in so doing, encouraging a philosophy to protect our natural capital (as the “loved destination”).

Another objective focuses on being an inclusive and accessible destination. That means being - and becoming – a place that attracts and caters for all types of visitors, offering “adventure for

31 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

everyone” and a “warm welcome for all”. This requires suitable facilities, movement infrastructure (including digital infrastructure, signage, information and promotion) and information and guidance for businesses. Both the Lake District and Yorkshire Dales National Park Management Plans have priorities related to making them places that are “welcoming for all”.

It is not possible to deliver on the first three objectives without a sector - and supporting infrastructure - that has the capability to deliver world class experiences. This fourth overarching objective is therefore about supporting the visitor economy sector to be resilient, to operate effectively and to support innovation and productivity. It addresses the opportunities and challenges in the delivery of services to visitors.

Although there a few larger businesses in Cumbria, the vast majority of visitor economy businesses in Cumbria are SMEs, with the emphasis on small or micro. Businesses can struggle to access information/suppliers and to find time to consider how to improve their businesses and address opportunities and challenges.

3.3 OBJECTIVE - INCREASING THE VALUE AND PRODUCTIVITY OF THE VISITOR ECONOMY

This objective comprises of five key strands which largely build on - and are a continuation of - the past focus of partners involved in the visitor economy.

3.3.1 �Growth Priority 1A - Continue to implement the strategy to raise the appeal and awareness of less well-known and visited parts of the county.

There are specific places in Cumbria which are already extremely popular, whilst there are other areas where there is much greater capacity to absorb visitor numbers and the extra visitor spend would be particularly beneficial (see Appendix B). For many years Cumbria has followed an “attract and disperse” strategy to try and increase visitor activity and increase the share of visitor value and wider benefits in less well-known and visited parts of the county.

The DMP is intended to redouble and refocus efforts on this strategy. The focus is about encouraging both day and overnight visitors to discover, visit and spend time and money in less well-known locations as well. This will involve a mixture of investment in alternative attractions/ trails and sustained marketing and promotion. Given forthcoming planned investments in several under-visited locations, including Carlisle and Barrow, there is a real opportunity to make progress here.

It will be important that additional visitor numbers in these areas are strategically managed (e.g. in more rural areas of Cumbria where there may be limited infrastructure for visitors).

Encouraging visitors to visit or stay in parts of the West Coast has long proved challenging. In part, this is due to distance and travel accessibility, and in part, it reflects the range of visitor product that is available. There is significant investment going into improving places and facilities in several West Coast towns. However, although these will help encourage more visitors, they are not at the scale of transformational projects of regional or national significance. As part of this priority area, partners will continue to explore the scope for more transformational projects in West Cumbria.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 32

3.1: Under visited opportunity areas in Cumbria

The areas which are relatively undiscovered and under visited in Cumbria include:

• Some parts of the Western Lake District (e.g. the coastal part of the National Park).

• Areas immediately adjacent to Lake District National Park:

◦ Cockermouth

◦ The West Coast

◦ Ulverston/Furness Peninsula and the Cartmel Peninsula

◦ Barrow

◦ Kendal

◦ Penrith and the Eden Valley

Figure

HADRIAN’S WALL I I I I I I I I I II I II I I I I I I I I NORTHUMBERLAND CARLISLE COCKERMOUTH KENDAL WORKINGTON GRASMERE CONISTON ULVERSTON LANCASTER WIGTON LANCASHIRE YORKSHIRE COUNTY DURHAM SCOTLAND KESWICK SEDBERGH APPLEBY-INWESTMORLAND PENRITH ALSTON KIRKBY STEPHEN WINDERMERE WHITEHAVEN SHAP HAWKSHEAD CARTMEL M6 S o l w a y F i r t h N o r t h P e n n i n e s ARNSIDE BRAMPTON MARYPORT AMBLESIDE RAVENGLASS MORECAMBE BARROW-INFURNESS BOWNESS-ONSOLWAY SILLOTH 39 38 37 36 35 34 42 41 40 43 NEWBY BRIDGE KIRKBY LONSDALE 44 S S M6 S S SOLWAY COAST NATIONAL LANDSCAPE ARNSIDE & SILVERDALE NATIONAL LANDSCAPE NORTH PENNINES NATIONAL LANDSCAPE GRANGEOVER-SANDS A683 A591 A590 A595 A5074 A684 A65 A6 A66 A685 A686 A69 A66 A595 A595 A7 A6071 A591 A689 A6 A6 A5086 A593 A5084 A595 A595 A689 A66 A595 A5087 A592 A685 A66 A683 A683 A687 A590 A591 A596 A594 1 WEST COAST MAIN LINE 1 TYNE VALLEY LINE 1 SETTLE TO CARLISLE LINE 1 CUMBRIAN COAST LINE 1 FURNESS LINE 1 LAKE LINE Eskdale Great Langdale Duddon Valley Lyth Valley Borrowdale Th e H o w gills Wasdale Ennerdale 0 Miles 0 Kilometres 5 8 10 16 B/Minor Roads A Roads Motorway National Landscape Lake District National Park Yorkshire Dales National Park KEY 33 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

• Carlisle and Hadrian’s Wall Country

• The Solway Coast (which links to Hadrian’s Wall Country)

• The Yorkshire Dales in Cumbria (which link to the Eden Valley)

• The North Pennines National Landscape within Cumbria

3.3.2 Growth Priority 1B – Grow the all-season offer and become known as a year-round destination for all

All year-round tourism supports visitor management, by improving tourism business profitability and in staff recruitment and retention, by providing more permanent roles. Although Cumbria is already less seasonal than rural coastal locations in England (such as Cornwall, the South West and Northumberland) it has a much more pronounced pattern of visitor spend and occupancy than the national average. As noted earlier, a combination of 10% and 5% increases in visitor spend across the ten less well performing months of the year would increase overall visitor spend by some £270million (or 6%) in Cumbria. This requires further consideration around festivals and events in shoulder months, more all-weather attractions and of course, marketing.

3.3.3 Growth Priority 1C - Regain and grow international spend and other higher value overnight stays

CT’s research shows that international visitors tend to spend 55% more per person per day than domestic visitors. The pre-covid local research suggests that around 10% of our visitors are international, although for some operators, international visitors can account for as much as 25% of business.

Thanks to significant investment by the private sector over many years, alongside promotion by Cumbria Tourism - aligned to Visit Britain’s Strategy – the volume and therefore value of international visitors was growing pre-covid. Cumbria was beginning to see the benefits from international visitors countywide, with key markets including the US and Canada, China, Japan and Europe. Pre-Covid there was also evidence of the Indian market emerging.

The focus is on attracting international visitors who have already come to the UK. Therefore, the activity is not intended to lead to increased long haul (or short haul) air travel. Research shows that international visitors to Cumbria are much less likely to arrive and travel round by car. Within the UK, the DMP encourages international visitors to travel to and within Cumbria by low carbon forms of transport.

3.3.4 Growth Priority 1D – Convert more visitors to overnight stays and extend the length of stays

Overnight visitors have a much greater economic impact relative to their visit than day visitors. In 2022 the average spend per day associated with an overnight visitor was 65% above that of a day visitor, and the total economic impact of an average overnight visit was almost five times that of a day visit9

The economic impact of staying visitors relative to their environmental impact is generally much better than for day visitors – in terms of travel, carbon footprint and concentration on honey pot

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 34

9 Average spend per day of £55 for a day visitor and £91 for an overnight visitor. Total spend on average of £317 for each overnight visit, lasting an average of 3.5 days (all 2022 data).

locations. The priority is to try and increase the number of overnight visitors relative to day visitors10 and to increase the length of stay of overnight visitors in Cumbria.

The pandemic has had a severe impact on the shape of the inbound and outbound travel industry. The impact of Brexit has too, with challenges around attaining visas, competition from Schengen countries and negative perceptions of travelling to the UK. China is only just beginning to re-open and travel from Japan and other nations has been impacted by the war in Ukraine, as well as soaring flight prices and limited availability. International visits fell to just 1% of the total in 2020 and 3% in 2022.

As noted in Appendix B, overall international inbound tourism to the UK started to recover to pre-Covid levels in 2023. Cumbria began to see a distinct uplift in international visits and we now expect this to continue.

3.3.5 �Growth Priority 1E - Adapt to and lead market trends and opportunities to ensure Cumbria attracts future new and repeat visitors

The final growth priority reflects the need to respond to the ever-changing nature of travel and tourism trends and opportunities. It also reflects demographic and other trends in UK society and internationally. Cumbria needs to ensure it can attract the “next generation” of visitors from “Millennials” and “Generation Z”11 . There is a need to invest in promotion and the product to attract:

• Younger adult markets:

◦ Previously, there has been a concern that Cumbria was losing its attraction to younger adults12 and this could pose a long-term threat to the visitor economy if the awareness ofand/or the habit of visiting - Cumbria was lost (or never established).

◦ However, the shift in the age profile of visitors since 2019 has provided an opportunity. The proportion of children under the age of 16 has stayed stable, but the evidence suggests there are now more younger adults visiting Cumbria, and fewer older adults. In total, 40% of visitors to Cumbria are between 16 and 44 years of age, up from 27% in 2018. The share of visitors aged over 60 has dropped from 33% in 2018 to 13% in 2022.

The aim is to ensure the attractiveness and relevance of Cumbria to this group, for whom there are a wide range of choices.

• Accessibility markets: Visitors with accessibility requirements and their carers/families, in part reflecting the demographics of an ageing population.

◦ Cumbria Tourism’s 2022 Visitor Survey reveals 14% of visitor groups included someone in their party with health issues or a disability that limits their daily activities. In respect to wellbeing and mental health, 93% of all visitors said they felt better physically from visiting the Lake District. 94% felt better mentally from visiting the LDNP - up from 80% in 2015.

◦ With the numbers of disabled visitors looking to enjoy Cumbria’s countryside on the increase, partners are committed to raising awareness and facilities servicing this important audience. Making tourist experiences more accessible will have a wider impactbenefiting groups such as parents with prams and the elderly too.

10 In practice this is not as simple as “converting” day visitors to stay overnight as the markets and motivations can be quite different.

11 Millennials are generally taken to be born between 1981 and 1996 (i.e. now in their mid-20s and 30s) and Generation Z were born 1997 to 2010 (i.e. mid-20s and younger).

12 There is no hard and fast definition of “younger adults”; they could be those under 30 or even under 40. In marketing or sociological terms, they might be called “Millennials” (around 25 to 40 at present) and “Generation Z” (under 25).

35 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

◦ But despite these incredibly positive developments it remains difficult for a disabled person/their family/friends to readily find the information they require to access this area and these facilities, either before or after arrival. This lack of information has been identified as one of the main barriers for people with an impairment who wish to visit the area.

◦ The aim is to put Lake District Cumbria on the map as one of the leading outdoors focussed accessible destinations in the UK.

• Visitors from ethnic minorities and other national backgrounds living in the UK:

◦ For many years, the evidence was that the Lake District and Cumbria had low rates of visitation by people from ethnic minority backgrounds (which is true in all National Parks).

◦ In 2022, 16% of visitor groups included someone in the party from an ethnic minority community – up from just 2% in 2018. This changing visiting pattern represents an opportunity to attract a more ethnically diverse range of visitors to Cumbria than has historically been the case, with the share of residents in Cumbria’s historic main catchment area13 from ethnic minority backgrounds likely to rise in the future.

There are also potential opportunities from business tourism which could be developed in Cumbria. However, the capacity to host significant business events is limited in the county and the market in the UK is focussed on cities or seaside/spa towns with large event spaces and hotel stock. The focus of business tourism in Cumbria therefore needs to be intrinsically linked to its distinct offer.

There are also significant opportunities from tourism linked to film and TV programmes. This stems both from the contribution to the visitor economy whilst filming is taking place, but more importantly, from the marketing and profile it can give to particular locations14 .

There are opportunities to expand event-based tourism in Cumbria. A sub-group of SVMG has been set up to support attract and disperse, sustainable and inclusive tourism, season extension, increase in overnight stays etc.

This will lead to a film and TV strategy that supports our destination priorities to establish:

• What kinds of events we want

• When we want them

• Where we want them

• Whether they fit our destination priorities

• What we don’t want, when and where.

13 The North West, North East and Yorkshire and the Humber regions (in 2015 and 2018 accounting for half of all visitors (UK and international), but over three quarters in 2022).

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 36

14 Visit Britain has teamed up with the British Film Commission to launch Starring Great Britain in 2024 and will be working with studios and production companies to promote films, TV series and their locations.

3.4 OBJECTIVE – RESPONSIBLE & SUSTAINABLE

SUPPORTING RESPONSIBLE TOURISM, BENEFITTING THE ENVIRONMENT AND VIBRANT COMMUNITIES

Sustainable Priority 2A:

Enhance and expand the opportunities and capabilities for convenient, low carbon visitor movement and experience(s) both into and inside Cumbria for the benefit of visitors, residents and workers

Sustainable Priority 2B:

Promote and support sustainable and active travel and experiences

These are both critical elements of the overall objective. The Lake District National Park has been something of a test bed for sustainable transport initiatives and this is a key focus of its Management Plan.

This involves helping and encouraging more visitors to arrive by modes of transport other than car, or if they do arrive by car, helping them to minimise their usage during their stay in Cumbria. It includes encouraging walking and cycling, as well as using local buses, train services and boats/ferries. It also covers the use of electric vehicles to and inside Cumbria. This requires improvements to some of our infrastructure, in particular, investment to improve the capacity and reliability of the railway lines in Cumbria. Enhanced bus service provision is also needed, supported by reliable and easy-to-use online information about route planning which can be accessed ‘on the go’, as well as traditional offline information sources. Critically, it requires proper coordination of different modes to create a genuinely integrated “end to end” transport system.

Sustainable and active travel needs to become easy, fun and a ‘must do’ integral part of the visitor experience, becoming a motivator for visiting. Investment in active travel routes will form a key part of improving this part of the visitor offer.

The UK is seeing growth in the ownership and use of EV and hybrid vehicles and increasingly, visitors arriving in these vehicles will be seeking reassurance they can charge their vehicles both en-route and whilst staying in Cumbria. However, there is a long way to go in terms of rolling out an EV charging infrastructure across Cumbria and its main visitor destinations. A report by CaFS15 indicated that (taking mid-range figures) 4,250 public chargepoints could be required in Cumbria by 2030 to meet the combined public and visitor demand (or a rate of circa. 40 new public charge points every month from the base of c. 260 in May 2021). Recent funding received by our local authorities, plus investment by the private sector, will help stimulate improved provision of EV charging points.

Achieving these objectives will require partners to continue making the case for investment in transport in Cumbria, through business cases and funding bids. It can sometimes be difficult to make the case for transport in more rural areas, but we can make the case stronger by focusing on the significant contribution visitors make to the Cumbrian economy.

Electric Vehicle Charging Deployment in

Analysis & Forecasting, CaFS, June 2021` (they quote a

of 2,100 to 6,400 and we have taken the mid-point of this range or 4,250). 37 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

15

Cumbria,

range

3.4.1 Sustainable Priority 2C: Increase the local social and economic benefit from visitor spend, supporting the vibrancy of our villages, towns and city

Visitors bring considerable economic benefits to local communities and many businesses have worked hard to increase their local content. However, a significant proportion of visitor spend still “leaks” out of Cumbria’s economy, losing value from the local economy and adding to carbon emissions. Reducing this “leaky bucket” is about both supply chain development and education/ awareness of visitors and businesses.

3.4.2 Sustainable Priority 2D: Encourage, educate and engage all visitors in responsible tourism, protecting and valuing our environment and communities

There is a national and global challenge/opportunity to increase awareness and encourage visitors to champion “responsible tourism”. As part of the DMP, we are seeking to redouble our collective efforts to educate, engage, inspire and support visitors to choose behaviours that make this as easy as possible (e.g. reduce waste, litter, etc).

This requires collective effort including that of visitor economy businesses to encourage and educate visitors in responsible tourism behaviour (providing information and advice in advance of visits and whilst in Cumbria).

This is also an opportunity to further develop visitor activity linking tourism and heritage/ environment. For example, increasing tourism based on learning traditional skills, practical conservation work, local food/produce, learning about farming, volunteering, etc.

3.4.3

�Sustainable Priority 2E: Support activities that sustain and enhance

the environment

The DMP recognises that visitors directly - and visitor economy businesses directly and indirectly - create environmental footprints from their activities. It is important that visitor economy businesses, partners involved in the DMP and visitors themselves further contribute to actions that reduce or offset environmental damage and contribute to improving the environmental resilience and quality of Cumbria. This covers air quality, water quality, resilience to flooding and waste levels ,as well as the carbon footprint of activities.

It also means ensuring access to Cumbria’s countryside, including the challenges of maintaining the footpath and bridleway network, which is vital for recreation.

The DMP supports actions that:

1. Offset direct environmental impact from visitor activities (e.g. via Fix the Fells) and lead to environmental improvements and improved sustainable visitor access.

2. Help generate funding to invest in environmental improvements (and visitor facility improvements).

3. Encourage and help visitor economy businesses to become more environmentally sustainable (e.g. reducing water usage or reducing food waste/food miles). (See also Support Priority 4C)

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 38

3.4.4 �Sustainable Priority 2F: Actively monitor and manage visitor pressure on key tourism destinations

The focus here is to take a proactive approach to maintain the visitor experience and minimise any adverse environmental impacts from visitors.

The actions include promotion and marketing of alternative locations (i.e. the “disperse” part of Objective 1A), as well as visitor management to reduce pressures on key locations, supported by real-time data sharing and interpretation.

The Strategic Visitor Management Group (SVMG) was set up in 2020 to respond to concerns about visitor pressure during covid. Its members are: Cumberland Council, Cumbria Police, Cumbria Tourism, the LDNPA, National Trust, Forestry England, Westmorland and Furness Council, Highways England and the Lake District Search and Mountain Rescue Association.

Fix the Fells helicoper lifts

Fix the Fells helicoper lifts

39 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

© AdeGidneyPhotography

3.5 OBJECTIVE - INCLUSIVE & ACCESSIBLE

ENSURING ALL VISITORS CAN ENJOY CUMBRIA AS A DESTINATION

3.5.1 Inclusive Priority 3A: Ensure Cumbria’s infrastructure and welcome is accessible to all

There has been good progress in making parts of the visitor infrastructure accessible to those with additional accessibility needs. Cumbria is in some respects a world leader in the provision of outdoor experiences for those with disabilities via bodies such as the Lake District Calvert Trust and the Bendrigg Trust. As we face an increasingly ageing population the number of visitors (both from within and outside the county) with accessibility and mobility issues will increase. The so called “Purple Pound” is already important for the visitor economy and will grow in the future. There is much more that can be done in respect of accommodation, training for businesses, visitor facilities and accessible trails.

3.5.2 Inclusive Priority 3B: Ensure Cumbria’s product and welcome is inclusive for all visitor groups

Linked also to Priority 1E about new market opportunities, the DMP seeks to expand visits from groups that have traditionally been less likely to visit Cumbria: younger adults, people from minority ethnic backgrounds and people with disabilities and access needs.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 40

Keswick to Threlkeld Railway Trail

3.6 OBJECTIVE - RESOURCED TO DELIVER

SUPPORTING THE SECTOR AND ENSURING THE INFRASTRUCTURE TO DELIVER WORLD CLASS EXPERIENCES AND MEET THE NEEDS OF COMMUNITIES

3.6.1 �Support Priority 4A: Develop better infrastructure and attract investment in the quality and range of product

Essentially this is about supporting business, where appropriate, to invest in their visitor product. For instance, in accessing grant funding or private investment. We seek to attract world-class development into new or improved tourism product, building on past investment in high quality arts and cultural facilities, high-end hotel and spa facilities, and a wide range of new types of visitor accommodation (from yurts to treehouses).

3.6.2 �Support Priority 4B: Attract, retain and develop a skilled and committed workforce

At present, the most significant business issue for most visitor economy businesses is access to people and their skills. In many parts of Cumbria there are unfilled posts at every level of the business. The sector cannot deliver world class experiences without a trained and committed workforce. Therefore, this strand is a key element of the DMP.

There is current work, led by Cumbria LEP, that is aimed at addressing labour shortages across Cumbria for all sectors including the visitor economy sector and where CT, as LVEP, has the lead co-ordinating role.

The DMP recognises the need for a holistic approach to skills and labour supply for the visitor economy sector where worker transport and access to accommodation are critical issues.

3.6.3 Support Priority 4C: Support businesses to move to more environmentally sustainable operations

This is a complementary strand to those in Sustainable Priority 2, which are about working with visitors to reduce their carbon footprint. It is about helping businesses deliver lower carbon emitting goods and services for the visitor economy. There is support for business decarbonisation in parts of Cumbria from the UK Shared Prosperity Fund until at least the end of 2024/25.

3.6.4 Support Priority 4D: Support businesses to adapt, innovate and achieve excellence

There is a need for considerable change across the sector to deal with labour shortages, to address the increasing impact of digital and other technologies. The development of new technologies such as AI has the potential to have major impacts on aspects of the visitor economy sector (for instance in relation to navigation, interpretation, and potentially some customer facing services) as well as advanced wireless connectivity. Funding from the UK Shared Prosperity Fund has the potential to underpin such support, including for new start-ups, at least until the end of 2024/25. The Borderlands 5G Innovation Regions programme will also provide opportunities for businesses and stakeholders to engage with a range of new technologies.

41 A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030

3.6.5 Support Priority 4E: Ensure digital connectivity (both mobile and fixed line) is fit for the future

Access to ever improved digital connectivity in buildings and on the move will be essential for a successful visitor economy, apart from a small niche market who wish to deliberately be “off the grid”. Cumbria continues to have significant “not spots” where there is no - or very limited - 4G signal (see Appendix B). The roll-out of 5G presents - especially in light of the Borderlands being named a 5G Innovation Region - both opportunities and the threat of an increasing digital divide if Cumbria fails to keep up with the UK-wide levels of services. Parts of Cumbria, especially in the Lake District, present an opportunity to explore/pilot alternative means of providing mobile digital connectivity that has the most limited environmental impact. For example, the potential use of small cell advanced wireless networks mounted on existing public assets as proposed for the Windermere 5G Ferry pilot in the Borderlands 5G Innovation Regions programme.

3.6.6 Support Priority 4F: Ensure provision of adequate and consistent visitor services across Cumbria and Support Priority 4G: Ensure a joined-up approach to enable a resilient visitor economy

There are a range of issues and basic services needed by visitors to Cumbria (covering signage, public realm, parking provision, litter management, toilets, black and grey waste provision for motorhomes, etc). We need to ensure these essentials are available to the right quality, are properly maintained and are consistent across visitor locations in Cumbria.

A DESTINATION MANAGEMENT PLAN FOR CUMBRIA: 2024 TO 2030 42

Cumbria Coastal Route (CCR200)

AMBITIONS AND OUTCOMES 4

43

Carlisle Citadel ©D&H Photography

It is important to have a framework for measuring progress towards the vision and across the objectives of the DMP.